Ending a car lease early sounds like a nightmare-until you find out about lease pull-ahead programs. These are real offers from manufacturers and lenders that let you walk away from your lease months early, often with little or no extra cost. If you’re tired of your car, want to upgrade, or just need to cut losses, this isn’t a loophole. It’s a structured escape route built into your lease contract-whether you realize it or not.

What Exactly Is a Lease Pull-Ahead Program?

A lease pull-ahead program lets you turn in your car before your lease ends and skip the final few monthly payments. In return, you usually have to sign a new lease on another vehicle from the same brand. It’s not a free pass. You’re trading one lease for another, but you’re saving money on the last 3-6 months of payments, and sometimes even getting a lower rate or cash incentive on the new car.

These programs aren’t advertised on billboards. You won’t find them on CarMax or Autotrader. They’re sent directly to leaseholders via email or mail, often 60-90 days before your lease ends. If you haven’t gotten one yet, call your leasing company and ask: “Do you have any pull-ahead offers for my account?”

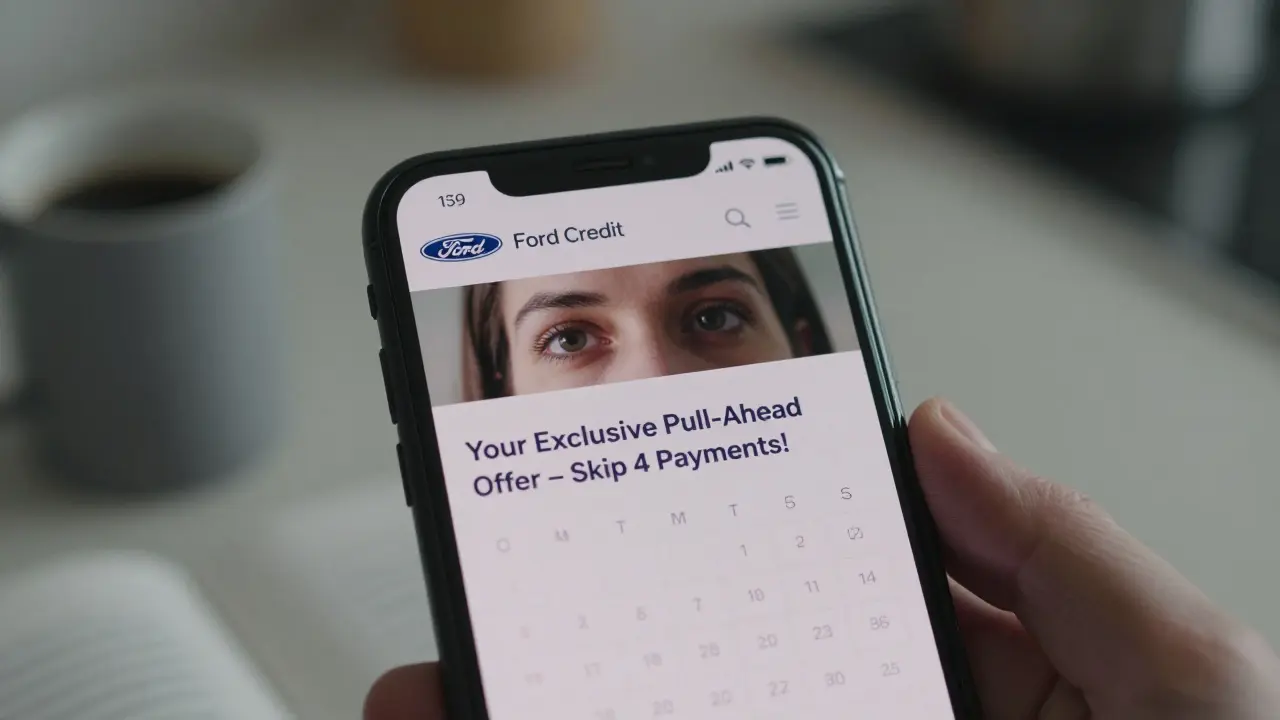

For example, Ford’s pull-ahead program in late 2025 offered customers with leases ending between March and June 2026 the chance to skip the final four payments if they leased a new 2026 Ford Explorer. The catch? You had to take delivery by June 30, 2026. No trade-in needed. No penalty. Just a new lease agreement.

Why Do Automakers Offer These Programs?

It’s not generosity. It’s supply chain math.

Manufacturers want to move new inventory fast. If you’re sitting on a 2023 model with 24 months left, they can’t sell it as new. But if you trade it in early for a 2026 model, they clear space in their warehouse and hit quarterly sales targets. Pull-ahead programs help them avoid overstocking while keeping you in their ecosystem.

They also know you’re already a loyal customer. You’ve trusted them with your monthly payments. Now they’re giving you a reason to stay-instead of switching to Toyota or Hyundai.

These programs work best when new models have strong demand and inventory is low. In 2025, with EVs and updated SUVs rolling out, brands like Hyundai, Kia, and Genesis were running aggressive pull-ahead deals to clear older lease returns.

When Should You Use a Pull-Ahead Program?

Not every leaseholder should jump on this. Here’s when it makes sense:

- You’re within 3-6 months of your lease end date

- You’re happy with the brand and want to stay in it

- Your car has low mileage and no excessive wear

- You’re ready for a new car and don’t want to wait

- You’re tired of repairs or the model feels outdated

Don’t use it if:

- You’re over your mileage limit by 10,000+ miles

- You have major dents, scratches, or tire wear that’ll cost you $1,500+ in fees

- You don’t plan to lease again

- You’re trying to escape because you can’t afford the payments

If you’re struggling to pay, pull-ahead won’t fix that. You’ll just trade one payment for another. Look into lease transfer services or early termination options instead.

How Much Can You Save?

Let’s say your monthly lease payment is $425. You have five months left. A pull-ahead offer lets you skip those payments. That’s $2,125 saved right there.

Now add the bonus: many programs throw in a $1,000-$2,500 lease incentive on your new car. Some even cover your first month’s payment or reduce your down payment by $1,500.

One Michigan resident in 2025 used a pull-ahead deal to end a 2022 Honda Civic lease early. He saved $2,100 on his remaining payments, got a $2,000 incentive on a 2026 Civic, and lowered his new payment from $399 to $315. Total savings: over $4,000 in the first year alone.

Compare that to early termination fees, which often run $300-$1,000 plus the remaining payments. Pull-ahead can cut your exit cost by 80% or more.

How to Find Your Pull-Ahead Offer

Don’t wait for it to arrive. Be proactive.

- Log into your leasing company’s website ( Ally, Ford Credit, BMW Financial, etc.)

- Check your messages or account dashboard for “lease renewal,” “early termination,” or “special offers”

- Call customer service and ask: “Do I qualify for any pull-ahead programs?”

- Ask for the offer in writing-email or PDF

- Compare the new lease terms: payment, term length, mileage, incentives

Some companies hide these offers behind login walls. Others send them only to customers with good payment histories. If you’ve been late even once, you might be excluded. But it never hurts to ask.

Pro tip: If you’re leasing through a bank (like Chase Auto Finance), ask if they partner with any manufacturers on pull-ahead deals. Sometimes the bank has a deal you didn’t know about.

What to Watch Out For

Not all pull-ahead offers are created equal. Here’s what could trip you up:

- Extended lease term: They might make your new lease 48 months instead of 36. That lowers your monthly payment, but you’re locked in longer.

- Higher mileage cap: If you’re offered a 15,000-mile cap but you drive 20,000, you’ll pay more in overage fees later.

- Hidden fees: Some programs charge a $500 administrative fee even if you skip payments.

- Non-transferable incentives: The $2,000 incentive might only apply if you finance through their lender. If you pay cash, you lose it.

- Trade-in restrictions: You might be forced to trade in your current car-even if it’s worth more than the residual value.

Always read the fine print. Ask for a breakdown of every charge and credit. If they won’t give you a line-by-line summary, walk away.

What If There’s No Pull-Ahead Offer?

If your leasing company doesn’t have one, you still have options.

Lease transfer: Sites like Swapalease and LeaseTrader let you find someone to take over your lease. You pay a small fee ($100-$300), and they take over payments. You’re off the hook. But your credit may still be tied to the lease until it ends.

Early termination: You pay the remaining payments minus a discount (usually 50-70% of what’s left). Plus, you pay an early termination fee ($200-$500). It’s expensive, but sometimes cheaper than paying for six months you don’t want.

Buyout and resell: If your car’s market value is higher than the residual value, you can buy it and sell it for profit. In 2025, some 2023 Honda CR-Vs had residuals of $18,000 but sold for $22,000 on the used market. That’s $4,000 in profit after fees.

Bottom Line: Pull-Ahead Is Your Best Bet

Lease pull-ahead programs are the smartest, cheapest way to exit a car lease early-if you’re eligible. You save money, avoid penalties, and get a new car. It’s the only exit strategy that rewards you for staying loyal.

Don’t wait until your lease ends to think about this. Start checking your account in the 6th month. Call your lender. Ask for the offer. Compare the numbers. If the math works, sign it. You’re not breaking the contract. You’re using it the way it was designed.

And if you don’t get an offer this time? Next lease, ask for pull-ahead terms upfront. Make it part of your negotiation. The best deals aren’t found-they’re requested.

Can I use a pull-ahead program if I’m over my mileage limit?

Yes, but it depends. Most pull-ahead programs still require your car to be in good condition. If you’re way over your mileage, the leasing company might still charge you for excess miles even if you skip payments. Always ask if the offer includes mileage forgiveness. Some do, especially if you’re trading up to a higher-trim model.

Do pull-ahead programs affect my credit score?

No, if you’re approved and follow the terms. Pull-ahead programs are reported as a lease termination and new lease, not a default. As long as you’re current on payments and sign the new agreement, your credit report will show a clean transition. Late payments or skipped payments, however, will hurt your score.

Can I use a pull-ahead offer on a leased electric vehicle (EV)?

Yes. In fact, EV manufacturers like Hyundai, Kia, and Rivian have been more aggressive with pull-ahead deals in 2025. EVs depreciate faster than gas cars, so automakers want to move them off lease quickly. Many EV pull-ahead offers include free charging credits or home charger installation as part of the incentive.

What if I want to go to a different brand?

Pull-ahead programs are usually brand-specific. If you want to switch to Toyota or Ford, you won’t get the offer unless you stay with the same manufacturer. But you can still use the savings from your current lease to lower the down payment or monthly payment on a new car from another brand. It’s not as seamless, but it’s still a financial win.

How soon after ending a lease can I lease again?

You can lease again the same day. Many dealerships will let you drive off the lot in your new car right after you drop off your old one. The only delay is paperwork. If you’re financing through the same lender, they often have the new lease ready to sign before you even leave the lot.

Aimee Quenneville

January 5, 2026 AT 19:52Cynthia Lamont

January 6, 2026 AT 18:20Kirk Doherty

January 7, 2026 AT 00:53Dmitriy Fedoseff

January 8, 2026 AT 07:23Meghan O'Connor

January 8, 2026 AT 09:06Morgan ODonnell

January 10, 2026 AT 00:58Liam Hesmondhalgh

January 10, 2026 AT 03:28Patrick Tiernan

January 12, 2026 AT 02:54Patrick Bass

January 12, 2026 AT 03:48