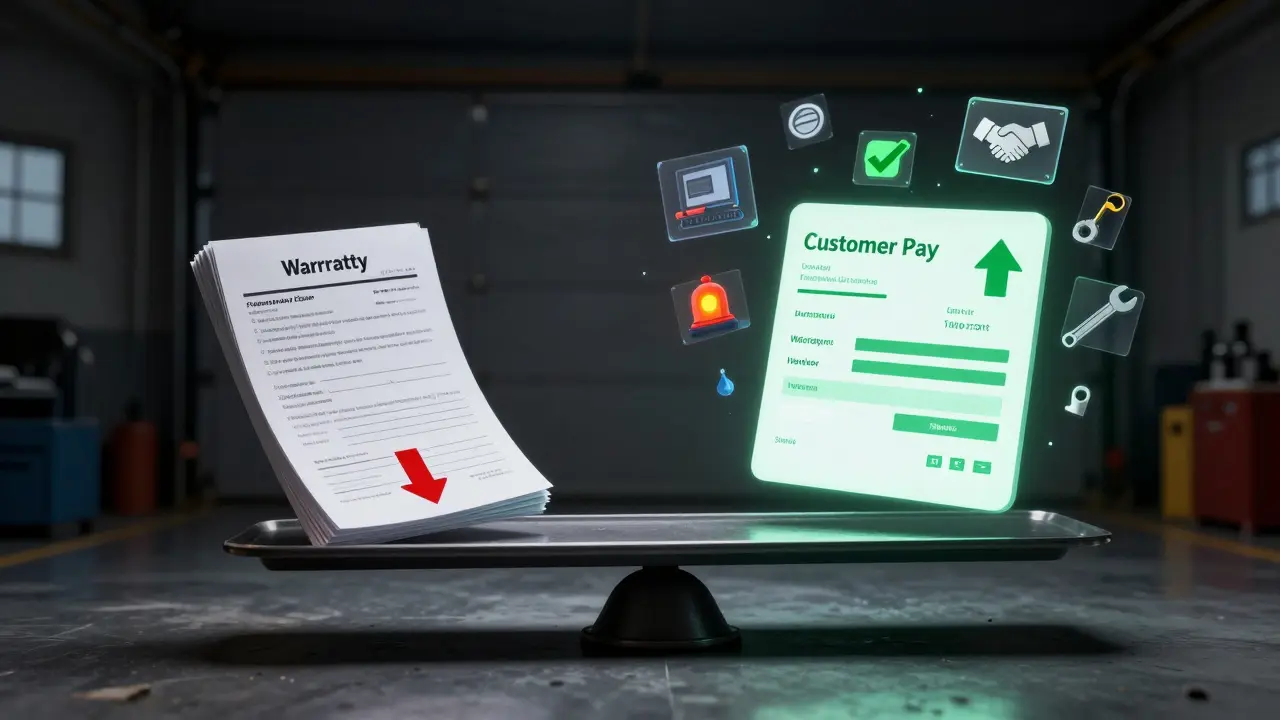

Most auto shops and service centers are stuck in a trap: they work harder but make less. Why? Because too many repairs are covered under warranty, and customers aren’t paying enough for the rest. The gap between what you charge and what you actually keep is wider than you think. Fixing this isn’t about raising prices-it’s about balancing customer pay and warranty mix the right way.

What’s Really Eating Your Profit?

Let’s say you fix 100 cars in a month. Thirty of them are under manufacturer warranty. That sounds good-free labor, right? But here’s the catch: warranty work pays less. You get paid a flat rate, often 20-40% below your normal labor rate. And you still use the same parts, tools, and tech time. Meanwhile, the other 70 jobs are customer pay. But if you’re charging $95/hour for labor and the average job takes 2.5 hours, you’re only making $237.50 per job before parts. That’s not enough to cover overhead, especially if you’re not upselling or diagnosing properly.

Real numbers from 2025 service data show that shops with a warranty mix over 35% are seeing net margins under 12%. Shops keeping warranty below 25% and pushing customer pay jobs into the 40-50% range are hitting 22-28% margins. The difference? It’s not luck. It’s strategy.

Customer Pay Isn’t Just About Charging More

Customer pay doesn’t mean jacking up your labor rate until customers walk out. It means making them see value in what you’re doing. Most drivers don’t know what’s wrong with their car-they just know it’s making a noise or the check engine light is on. Your job isn’t to fix the symptom. It’s to fix the problem before it gets worse.

Take a common case: a customer comes in because their car is overheating. The obvious fix is a coolant flush. But if you only do that, you’re leaving money on the table-and risking a bigger repair later. A good technician checks the thermostat, radiator cap, water pump, and hoses. You find a cracked hose that’s leaking slowly. You replace it. You explain why it matters. You show them the old part. You give them a written estimate. Now they’re not just paying for a coolant flush. They’re paying for peace of mind.

Shops that use diagnostic reports with photos and simple explanations see 60% higher customer pay acceptance rates. Customers don’t mind paying when they understand why. The key is transparency, not pressure.

Warranty Work Isn’t the Enemy-Poor Management Is

Warranty claims aren’t bad. They’re necessary. But they’re a cost center unless you treat them like a profit lever. Here’s what most shops do wrong:

- They accept every warranty claim without verifying eligibility.

- They don’t track warranty labor time vs. customer pay labor time.

- They don’t upsell during warranty visits.

- They let warranty jobs sit idle because they’re waiting for approval.

Here’s what works:

- Check warranty coverage before you start. Use the manufacturer’s portal-don’t guess. If it’s not covered, turn it into a customer pay job immediately.

- When you’re doing a warranty repair, always check related systems. If the timing belt is due, mention it. If the brake fluid is old, test it. Most warranty repairs are done on vehicles under 5 years old-those customers are prime for follow-up services.

- Use warranty visits as a chance to build loyalty. Send a thank-you email. Offer a $25 discount on their next customer pay service. Make them feel valued, not like a claim number.

One shop in Charlotte started tracking warranty labor efficiency. They found that 18% of warranty claims were for issues that weren’t covered. By training technicians to verify coverage upfront and document everything, they cut unapproved warranty claims by 62% in six months. That’s pure margin recovery.

How to Balance the Mix Right

You don’t need to eliminate warranty work. You need to control it. Here’s a simple formula that works for most shops:

- Set a target warranty mix of 20-25% of total repair volume.

- Track your monthly warranty vs. customer pay revenue separately.

- Calculate your net margin for each category: (Revenue - Parts Cost - Labor Cost) / Revenue.

- If warranty margin drops below 8%, investigate why. Is it too many denied claims? Too many low-value repairs?

- If customer pay margin is under 18%, look at your diagnostic process and upselling.

For example, if your total repair volume is $50,000 a month:

- Warranty: $10,000 (20%) → $7,500 revenue after parts, $6,000 net after labor

- Customer Pay: $40,000 (80%) → $32,000 revenue after parts, $24,000 net after labor

- Total Net: $30,000 → 60% gross margin, 24% net margin

Now shift to 25% warranty ($12,500) and 75% customer pay ($37,500). If you improve customer pay efficiency by 10% (better diagnostics, more upsells), your customer pay net jumps to $26,250. Warranty net stays at $6,000. Total net: $32,250. That’s a 7.5% margin increase just by adjusting the mix.

Tools That Actually Help

You don’t need fancy software. But you do need systems.

- Use a repair management system that tags jobs as warranty or customer pay. If your system doesn’t do this, switch.

- Install a tablet in every bay so techs can show customers photos of worn parts during the repair.

- Use automated SMS or email reminders for upcoming warranty expirations. “Your powertrain warranty expires in 30 days. Schedule a free inspection.”

- Train your service advisors to ask: “Is this covered under warranty?” before writing the ticket. If not, say: “Let me check what else might be going on before it gets worse.”

One shop in Asheville started using a simple Google Form for every warranty claim. Techs had to answer: “Is this covered?” “Did you check related components?” “Did you offer a follow-up service?” Within three months, their warranty approval rate dropped 15%, but their customer pay revenue rose 22%. They didn’t lose trust-they earned more respect.

When to Say No to Warranty

Not every claim should be accepted. If a customer’s vehicle is out of warranty by 30 days, and the issue is a known defect, you can still help. But you don’t have to eat the cost.

Example: A 2021 Honda Civic has a known issue with the transmission solenoid. The warranty expired 28 days ago. The customer comes in. You verify the issue. You tell them: “This is a known problem. Honda would cover it if you were 1 day earlier. But we can fix it for $899, which is 40% less than the dealer. And we’ll give you a 2-year warranty on the repair.”

They say yes. You made $899. You didn’t lose the customer. You built loyalty.

Shops that use this “warranty grace period” strategy see 30-40% of near-expiry claims turn into customer pay jobs. That’s free revenue from a problem you didn’t create.

Final Rule: Profit Comes from Control, Not Volume

More repairs don’t mean more profit. Better repairs do. You can’t fix your margin by working 12-hour days. You fix it by working smarter.

Start small:

- This week, track your warranty vs. customer pay volume.

- Next week, train your techs to show one photo of a worn part on every customer pay job.

- Next month, set a 25% warranty cap and see what happens.

The goal isn’t to avoid warranty. It’s to make every warranty job work for you-and every customer pay job pay you well.

What’s a good warranty mix percentage for a repair shop?

A healthy warranty mix is between 20% and 25% of total repair volume. Anything above 30% usually drags down your net margin because warranty labor rates are lower and administrative overhead is higher. Shops keeping warranty under 25% while boosting customer pay efficiency consistently hit 22%+ net margins.

Can I increase customer pay without raising prices?

Yes. Most customers are willing to pay more if they understand the value. Use diagnostic reports with photos, explain why a part failed, and show how skipping a repair could lead to bigger costs. Shops that do this see 60% higher approval rates on upsells-even without price increases.

Why do warranty repairs hurt my profit?

Warranty repairs pay a fixed labor rate set by the manufacturer, often 20-40% below your normal rate. You still pay your techs the same, use the same parts and tools, and spend the same time. Plus, warranty claims often require extra paperwork, delays, and rejections. If you’re not managing them tightly, they become a cost center, not a revenue source.

Should I turn down warranty claims?

Never turn down a valid claim. But always verify eligibility before starting work. Many claims are submitted for issues that aren’t covered-like wear-and-tear parts or damage from neglect. If it’s not covered, offer a fair customer pay price and explain why. Most customers will pay if you’re honest and helpful.

How do I train my techs to spot upsell opportunities during warranty jobs?

Give them a checklist: When doing a warranty repair, check the condition of related components-brakes, fluids, belts, hoses, sensors. If anything is near end-of-life, note it. Train them to say: “While we’re here fixing [warranty item], I noticed your brake fluid is 2 years old. It should be changed every 2 years for safety. We can do it now for $89.” Keep it simple, factual, and non-pushy.

rahul shrimali

January 19, 2026 AT 21:28Stop overcomplicating this. Just show the customer the broken part, tell them why it matters, and charge what you’re worth. No fluff. No guilt. Just results.

poonam upadhyay

January 21, 2026 AT 12:47Ohhhhh, so now we’re supposed to ‘upsell’ during warranty repairs?? Like, sneak in a $200 brake fluid flush while they’re waiting for their ‘covered’ thermostat?? 😏 I love how this reads like a corporate training video written by someone who’s never actually talked to a real customer who’s already been burned by shady shops. You think people don’t notice when you turn a warranty visit into a ‘let me show you ALL the things that might break next year’ sales pitch??

And don’t even get me started on ‘documenting everything’-you mean like the 17-page PDFs I get from dealerships that look like a legal contract written in Klingon?? I just want my car fixed, not enrolled in a 3-hour seminar on automotive doom.

Also, ‘warranty grace period’?? Are we running a charity or a repair shop?? If it’s out of warranty, it’s out. Don’t try to guilt-trip someone into paying because ‘Honda would’ve covered it yesterday.’ That’s not trust-it’s manipulation wrapped in a ‘we’re on your side’ bow.

And why do all these ‘success stories’ sound like they were pulled from a LinkedIn post by a guy who owns three shops and drives a Tesla? Real mechanics? We’re not all in Asheville with tablets and Google Forms. Some of us are in back-alley garages with duct-taped scanners and techs who still write receipts on napkins.

Stop selling ‘strategy.’ Start listening. People aren’t mad you charge. They’re mad you make them feel stupid for not knowing what a ‘solenoid’ is.

Eka Prabha

January 22, 2026 AT 05:34While the operational framework presented herein exhibits a superficially coherent methodology for margin optimization, it fundamentally misapprehends the sociopolitical dynamics of consumer trust in post-industrial service economies. The implicit assumption that customers are rational actors who respond to diagnostic transparency ignores the systemic erosion of institutional credibility precipitated by decades of predatory pricing, obsolescence engineering, and corporate liability shielding via warranty exclusions.

Moreover, the normalization of ‘warranty verification protocols’ as a profit lever inadvertently institutionalizes a form of diagnostic colonialism-wherein technicians, acting as corporate intermediaries, interrogate vehicle ownership histories to extract maximal revenue from vulnerable populations. The ‘grace period’ strategy, in particular, constitutes a coercive temporal manipulation, exploiting the precise window between warranty expiration and mechanical failure to convert systemic corporate negligence into individualized financial obligation.

Furthermore, the recommendation to ‘train service advisors’ to ask ‘Is this covered under warranty?’ prior to writing the ticket reveals a profound epistemological flaw: it presumes that the customer possesses the technical literacy to discern coverage eligibility, when in reality, such knowledge is deliberately obfuscated by manufacturers through proprietary diagnostic codes and non-disclosure agreements. This is not transparency-it is performative compliance.

Until the industry abandons its fetishization of ‘margin metrics’ and confronts the structural exploitation embedded in warranty systems, these ‘best practices’ will merely function as neoliberal veneers over a fundamentally extractive model.

Bharat Patel

January 24, 2026 AT 00:16There’s something beautiful about how a car becomes a mirror for how we treat people. You fix a hose because it’s leaking? That’s care. You show the old part because they need to see it? That’s honesty. You offer a discount after a warranty job? That’s respect.

But the moment you start counting margins like poker chips, you forget why people bring their cars to you in the first place. Not because you’re the cheapest. Not because you’re the fastest. But because you made them feel like they weren’t being played.

Warranty work isn’t the enemy. Greed is. The second you see a customer as a revenue line instead of a person who’s stressed about their car breaking down, you’ve already lost them.

Maybe the real ‘mix’ isn’t warranty vs. customer pay. Maybe it’s profit vs. trust. And trust? You can’t upsell it. You can only earn it.

Bhagyashri Zokarkar

January 25, 2026 AT 00:13i just want to say i read this whole thing and im so tired now like why does everything have to be so complicated?? i just want my car fixed and not have someone show me 12 pictures of hoses and say ‘this could fail in 3 months’ and then charge me 300 bucks for something that wasnt even broken when i came in?? i mean come onnnnnnn

and why do all these shops act like theyre doing me a favor?? like i know my warranty expired but i dont need a lecture on ‘grace periods’ and ‘profit levers’ i just need someone to fix the noise and not make me feel like an idiot for not knowing what a solenoid is

also why is everyone talking about tablets and google forms?? i live in a small town and the mechanic still uses paper and pencil and i love him for it

just fix my car. please. with kindness. not a powerpoint.

Rakesh Dorwal

January 25, 2026 AT 03:06Let me get this straight-you’re telling me we should turn warranty claims into customer pay jobs because ‘Honda didn’t cover it by 28 days’? That’s not business, that’s betrayal. Our own companies design cars to fail just after warranty ends. They profit from the breakdowns. And now you’re telling mechanics to side with them??

This whole thing smells like corporate propaganda. You want us to ‘verify eligibility’? That’s code for ‘find loopholes to screw customers.’

And don’t get me started on ‘tablet photos.’ You think people care about a cracked hose? They care that their car works. Stop trying to make us into salesmen. We’re not Amazon. We’re not Apple. We’re mechanics. Fix the damn car. Stop turning trust into a spreadsheet.

And if you’re in India and reading this-you know what I mean. We don’t need your American corporate hustle. We need honest work.

Vishal Gaur

January 25, 2026 AT 17:01ok so i read this like 3 times and im still confused like are we supposed to be doing warranty work or not?? like if its covered then its covered right?? but then you say ‘check if its covered’ like its some kind of trick?? and then you say ‘upsell during warranty’ but if the customer finds out you’re trying to sell them stuff while they’re waiting for a free repair they’re gonna be mad

also the numbers dont add up i think you just made them up like ‘total net 30k’ how?? where did you get these numbers from??

and why does everyone keep saying ‘asheville’ and ‘charlotte’?? are we in america?? i live in hyderabad and no one here has tablets in the bays

just fix the car. be honest. dont overthink it. people know when you’re lying.

Nikhil Gavhane

January 26, 2026 AT 17:01I’ve been in this business for 22 years. I’ve seen shops come and go. The ones that lasted? They didn’t chase margins. They chased relationships.

I remember this one lady, 78 years old, came in with a 2015 Corolla. Check engine light. Warranty was long gone. I found a loose gas cap-$5 fix. I didn’t charge her. I just told her, ‘Next time, check this first. Saves you a tow.’ She came back every 6 months for oil changes. Brought cookies. Told her friends.

Warranty work? Fine. But if you treat every customer like a ticket to be maximized, you’ll burn out. Fast.

Do the right thing. Even when it’s harder. Even when it doesn’t pay more right away. Because in the end, trust is the only thing that lasts.

And yeah-I still write receipts on paper. And my techs still use their hands. And the customers? They still come back.