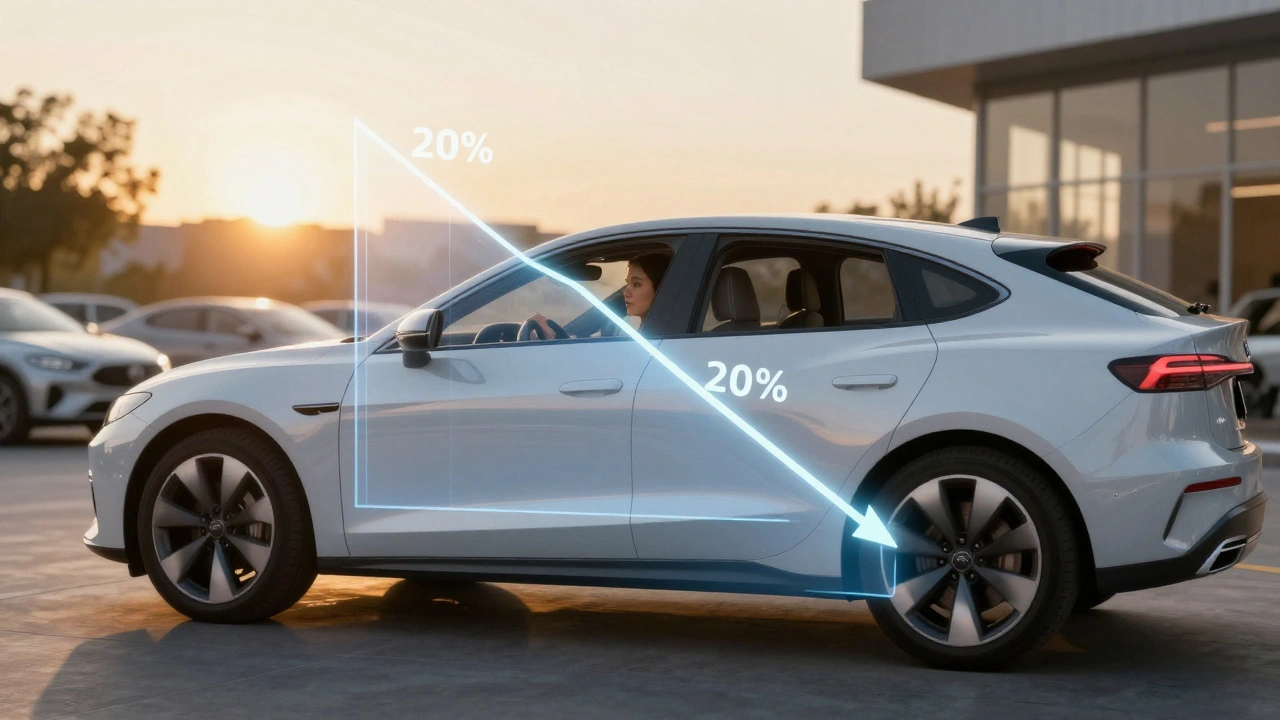

When you drive a new car off the lot, it loses value the moment you sign the papers. In fact, most new cars drop 20% in value within the first year. If you get into an accident or your car gets stolen in those first few months, your insurance payout might not even cover what you still owe on your loan. That’s where gap insurance comes in-but do you actually need it?

What Is Gap Insurance?

Gap insurance stands for guaranteed asset protection. It covers the difference between what your car is worth at the time of a total loss and what you still owe on your loan or lease. Most standard auto insurance only pays out the current market value of your vehicle, not the remaining balance on your financing.

For example, let’s say you bought a $35,000 car with $5,000 down and financed the rest. After eight months, you’re in an accident, and the car is totaled. Your insurer says the car is now worth $26,000, so they pay you that amount. But you still owe $30,000 on the loan. Without gap insurance, you’re stuck paying the $4,000 difference out of pocket. With gap insurance, they cover that $4,000, and you walk away without extra debt.

Who Needs Gap Insurance the Most?

Not everyone needs it. But if you fall into one of these categories, you’re at higher risk of being upside-down on your loan:

- You put less than 20% down on your car

- You financed the car for 60 months or longer

- You rolled over negative equity from a previous car loan

- You’re leasing a vehicle

- You bought a car that depreciates faster than average (like many EVs or luxury models)

A 2024 study by the Insurance Information Institute found that nearly 25% of new car buyers were upside-down on their loans within the first year. That’s one in four people who would’ve been stuck paying thousands extra without gap coverage.

How Much Does Gap Insurance Cost?

It’s surprisingly cheap. Most dealerships will try to sell you gap insurance for $500-$700 upfront, but that’s overpriced. If you buy it through your auto insurer-like State Farm, Geico, or Progressive-it typically costs $20 to $40 per year. Some credit unions even include it for free with certain loan terms.

Here’s a quick comparison:

| Source | Typical Cost | Pay Period |

|---|---|---|

| Dealership | $500-$700 | One-time fee |

| Auto insurer (Geico, State Farm, etc.) | $20-$40 | Per year |

| Credit union (with qualifying loan) | $0-$25 | Per year |

Buying through your insurer is almost always the smarter move. Dealerships bundle it into your loan, which means you’re paying interest on it for years. That $600 fee could end up costing you $800 or more over time.

When Gap Insurance Isn’t Necessary

There are situations where gap insurance adds no real value:

- You paid cash for your car

- You made a 20% or higher down payment

- Your loan term is 36 months or less

- You have a low-interest loan and plan to pay it off quickly

- You bought a car that holds its value well (like a Toyota Camry or Honda Civic)

If you’re not upside-down on your loan within the first two years, gap insurance won’t help you. And once your loan balance drops below the car’s market value-which usually happens after 2-3 years-you can cancel it.

What Gap Insurance Doesn’t Cover

It’s not magic coverage. Gap insurance only pays the difference between your car’s value and your loan balance. It won’t help with:

- Deductibles on your primary insurance

- Extended warranties or service contracts

- Missed payments or late fees

- Damage from negligence or illegal activity

- Lease-end charges like excess mileage or wear-and-tear

Some people think gap insurance covers everything if their car is totaled. It doesn’t. It only covers the loan gap. You still need comprehensive and collision coverage for the insurer to even trigger a payout.

How to Get Gap Insurance

You have three main options:

- Through your auto insurer - Most major carriers offer it as an add-on. Just call your agent and ask. It’s cheap and easy to add.

- Through your lender - Banks and credit unions sometimes offer it, especially if you have a long-term loan. Check your loan paperwork.

- Through the dealership - They’ll push it hard, but it’s usually the most expensive option. If you buy it here, make sure you’re not being charged interest on it.

Pro tip: If you’re buying a new car, wait until after you’ve signed the loan documents before talking to the finance manager. They’ll try to upsell you on a bundle of extras. Get your financing locked in first, then decide if gap insurance is worth it.

What Happens If You Don’t Have It?

Let’s say you’re one of the 25% of new car owners who are upside-down after a year. Your car is totaled. Your insurer writes you a check for $24,000. You still owe $31,000. You’re out $7,000. That’s not just a financial hit-it’s a life disruption. You might need to delay a move, postpone a vacation, or take on high-interest credit card debt to cover it.

Gap insurance isn’t about being paranoid. It’s about protecting yourself from a common financial trap that catches people off guard. You wouldn’t skip health insurance because you’ve never been hospitalized. Gap insurance is the same idea: low cost, high impact when you need it.

Should You Buy Gap Insurance?

Ask yourself these three questions:

- Did I put less than 20% down?

- Is my loan term longer than 48 months?

- Is my car model known for fast depreciation (like a Tesla Model 3, BMW 3 Series, or Hyundai Kona)?

If you answered yes to any of these, get gap insurance. Buy it through your auto insurer or credit union-not the dealership. It’ll cost less than a tank of gas and could save you thousands.

If you answered no to all three, you’re probably fine without it. Focus your money on building an emergency fund instead. That’s a better long-term safety net.

Final Thought

New cars are expensive. Financing them makes them even more expensive. Gap insurance is a small, smart shield against one of the most common financial surprises in car ownership. It’s not glamorous. It won’t make your car faster or prettier. But if you ever need it, you’ll be glad you had it.

Is gap insurance required by law?

No, gap insurance is not required by any state or federal law. However, some leasing companies require it as part of the lease agreement. Always check your loan or lease contract before assuming you don’t need it.

Can I cancel gap insurance later?

Yes. Once your loan balance drops below the car’s market value, you can cancel gap insurance. Most insurers will refund the unused portion of your premium if you cancel early. Check your policy terms, but you’ll usually get a prorated refund.

Does gap insurance cover mechanical failures or engine problems?

No. Gap insurance only applies when your car is totaled due to an accident, fire, theft, or other covered loss under your comprehensive or collision policy. It doesn’t cover repairs, breakdowns, or mechanical issues.

Do I need gap insurance if I have a 3-year loan?

Probably not. With a 36-month loan and a 20% down payment, most cars won’t be upside-down for more than a few months. By the time depreciation hits hardest, your loan balance will likely be lower than the car’s value. Still, check your loan amortization schedule to be sure.

Can I get gap insurance after buying the car?

Yes. You can usually add gap insurance up to 12-24 months after purchase, depending on the insurer. But the sooner you get it, the better-because depreciation happens fastest in the first year.

Next Steps

If you’re buying a new car this month:

- Calculate your loan-to-value ratio. If you’re financing more than 80% of the car’s price, gap insurance is a good idea.

- Call your auto insurer and ask how much gap coverage costs. Compare it to the dealership’s offer.

- Don’t sign anything until you’ve reviewed your loan terms and insurance options side by side.

If you already own a new car:

- Check your loan balance and current car value (use Kelley Blue Book or Edmunds).

- If you owe more than the car is worth, consider adding gap insurance now.

- If you owe less, you can safely drop it.

Gap insurance is simple, cheap, and often overlooked. But in the wrong situation, not having it can cost you more than the car itself.

Anuj Kumar

December 13, 2025 AT 09:00Gap insurance? Nah. That's just the bank's way of making you pay more. They know you're dumb enough to fall for it. Car loses value? Good. That's capitalism. You took the loan, now deal with it.

Christina Morgan

December 14, 2025 AT 22:53I love how this post breaks it down so clearly. As someone who just bought a used Honda Civic after years of being upside-down on a lease, I wish I’d known this sooner. Gap insurance isn’t about fear-it’s about not letting a bad day turn into a financial nightmare. Seriously, if you’re financing over 80%, just get it. $30 a year is nothing compared to scrambling for $5k.

Kathy Yip

December 15, 2025 AT 08:59i was just thinking about this yesterday because my friend totaled her tesla last month and owed 12k more than it was worth… she had gap ins and it saved her. but i also wonder if the reason so many people are upside down is because car prices are insane now? like, is gap insurance just a bandaid for a broken system? also, i think the table might be misaligned? the headers dont line up right on my phone.

Bridget Kutsche

December 16, 2025 AT 05:18This is such a practical guide-thank you for writing it! I used to work in auto finance and saw way too many people get blindsided by the gap. The dealership upsell is a trap. Always go through your insurer or credit union. Pro tip: if you’re leasing, gap is usually included, but read the fine print. And yes, cancel it once you’re no longer upside-down. That refund can go toward a vacation or new tires. Small wins matter.

Jack Gifford

December 16, 2025 AT 19:47Just a quick grammar note: in the table, the header row should be wrapped in <thead> and the rows in <tbody> for proper accessibility. Also, ‘$0-$25’ under credit unions-some might interpret that as free, but it’s not always. Check if it’s conditional on being a member for 12+ months. Small things, but they matter.

Sarah Meadows

December 17, 2025 AT 04:39Gap insurance is a socialist safety net disguised as financial advice. If you can’t afford the risk of depreciation, you shouldn’t be buying a new car. Americans are addicted to disposable luxury. Buy used. Save money. Build wealth. This isn’t a problem that needs insurance-it’s a problem that needs discipline.

Nathan Pena

December 17, 2025 AT 10:30The entire premise of gap insurance is predicated on a flawed assumption: that the consumer is irrational enough to finance a depreciating asset with a term longer than its useful economic life. The real issue isn’t the insurance-it’s the predatory lending structures that incentivize 72-month loans on vehicles with 5-year depreciation curves. The fact that this is even a market speaks to systemic financial illiteracy. Also, your table lacks proper semantic markup. Shame.

Mike Marciniak

December 18, 2025 AT 01:59Did you know that 87% of dealerships that push gap insurance also have hidden fees in the loan? They inflate the interest rate to cover the cost. The insurance isn’t the scam-it’s the way they bury it in the paperwork. Always ask for the APR breakdown before signing. They don’t want you to know this.

VIRENDER KAUL

December 19, 2025 AT 06:05