If you fall behind on your car loan payments, your vehicle can be taken back-no warning, no court order, sometimes even while you’re at work. This isn’t a threat from a movie. It’s what happens when a loan goes into default. And it’s more common than most people realize. In 2024, over 1.2 million vehicles were repossessed in the U.S., up 18% from the year before. If you’re struggling to make payments, you need to understand what comes next-not just the legal side, but the real-life fallout.

What Counts as Loan Default?

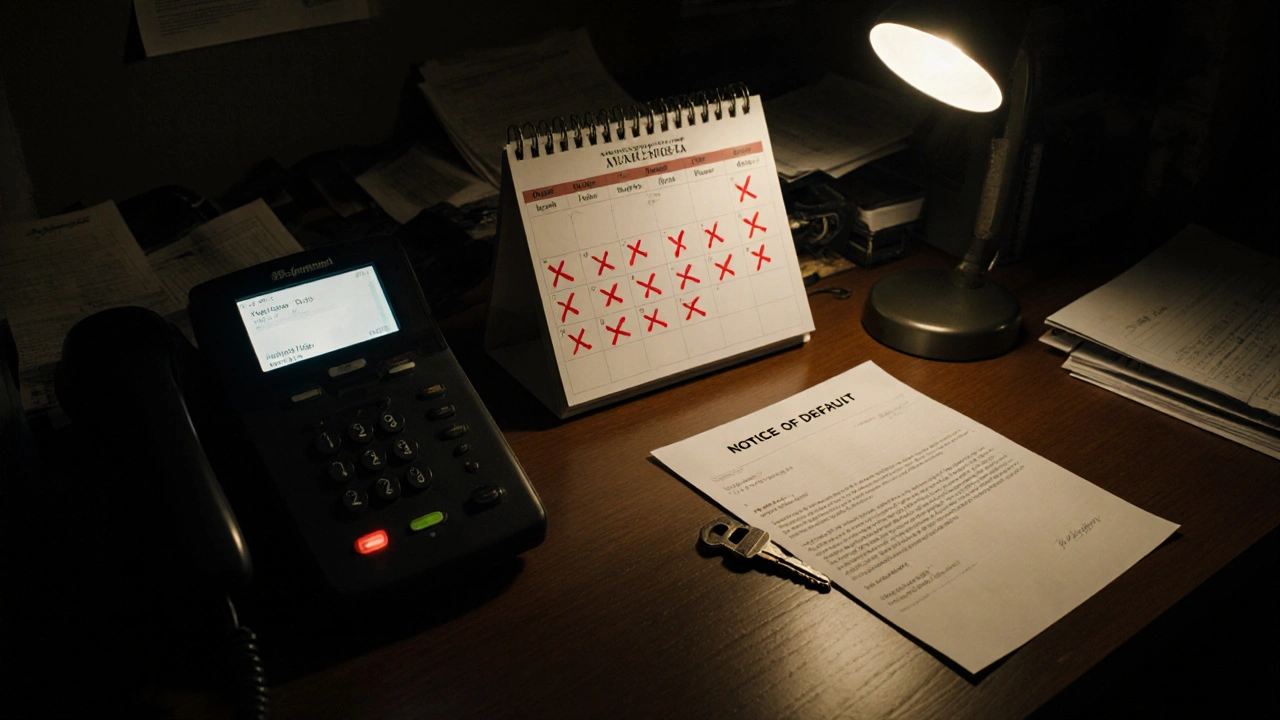

Default doesn’t always mean you missed three payments. Most lenders consider a car loan in default after 30 days of nonpayment. Some contracts say 10 days. Others say 60. It’s all in the fine print. The moment you miss a payment, you’re already violating the terms. But lenders usually wait before acting. Why? Because repossessing a car costs them money too. Still, you can’t assume they’ll wait. If your payment is late, the clock is ticking.Once you’re officially in default, the lender has the legal right to take your car. They don’t need your permission. They don’t need to notify you first. In most states, they can show up at your home, your workplace, or even a public parking lot and tow it away. No judge. No police. Just a repossession agent with a key and a truck.

How Repossession Actually Works

The process is cold, fast, and quiet. A repossession company, hired by your lender, will track your car’s location using GPS if your vehicle has a factory-installed tracker (most new cars do). They don’t break into garages or force their way in. That’s illegal. But they can take it from your driveway, a public street, or a shopping center parking lot. If the car is unlocked and the keys are inside, they’ll just drive off with it.Some people think hiding the car will help. It won’t. Moving the vehicle doesn’t erase the debt. It might even make things worse. If you’re trying to avoid repossession by keeping the car off the street, you could be charged with fraudulent concealment. That’s a civil offense-and in some states, a criminal one.

After the car is taken, you’ll get a notice. Usually within 5 to 10 days. It’ll tell you how much you owe, what you can do to get the car back, and the deadline. This is your last chance to act.

Can You Get Your Car Back After Repossession?

Yes-but only if you act fast. Most lenders offer a redemption period, typically 10 to 30 days. During that time, you can get your car back by paying the full balance: missed payments, late fees, repossession fees, storage fees, and any legal costs. That’s often $2,000 to $5,000 extra on top of what you already owed.Some people think they can just pay the missed payments and get the car back. That’s not how it works. You have to pay everything. And if you can’t? The lender will sell the car at auction. You’ll still owe the difference between what the car sold for and what you owed. That’s called a deficiency balance.

Let’s say you owed $15,000. Your car sells at auction for $8,000. You now owe $7,000. Plus fees. The lender can sue you for that. They can garnish your wages. They can freeze your bank account. They can even put a lien on your next car.

What Happens to Your Credit Score

A repossession stays on your credit report for seven years. That’s longer than most bankruptcies. It can drop your score by 100 to 200 points. If your score was 700 before, you’re now in the 500s. That means higher interest rates on everything: credit cards, mortgages, even phone plans.Some people think they can just wait it out. But lenders report to all three major credit bureaus: Experian, TransUnion, and Equifax. There’s no way around it. And if you’re trying to buy another car in the next few years? You’ll need a cosigner-or pay 18% APR instead of 5%.

Alternatives to Repossession

Before you miss a payment, call your lender. Seriously. Do it now. Most lenders have hardship programs. They might let you:- Pause payments for 30 to 90 days (forbearance)

- Extend your loan term to lower monthly payments

- Refinance with a different lender

- Trade in the car for a cheaper one

You won’t get this offer unless you ask. Lenders don’t advertise these options. They’re not required to tell you. But they’ll do it if you call before you’re late. The key is timing. Once you’re 30 days behind, your options shrink fast.

If you’re underwater on your loan (you owe more than the car is worth), trading it in isn’t easy. But some dealerships will roll the negative equity into a new loan. That’s risky-it just pushes the problem forward. But it’s better than repossession.

What to Do If Your Car Is Already Repossessed

First, don’t panic. Don’t ignore the letters. Don’t assume it’s over. You still have rights.- Call the lender immediately. Ask for the exact amount needed to redeem the vehicle.

- Ask if they’re selling the car at auction. If so, ask for the date and location. You have the right to attend.

- Check your state’s repossession laws. Some states require lenders to give you a notice of sale. Others require them to sell the car in a "commercially reasonable" way.

- If the car sells for way less than its value, you can dispute the deficiency. If they sold it for $5,000 but it was worth $12,000, you can argue the sale wasn’t fair.

- Don’t sign anything without reading it. Some lenders will try to get you to sign a waiver that gives up your rights.

If you can’t afford to get the car back, consider filing for Chapter 7 bankruptcy. It can wipe out the deficiency balance. But it’s not a quick fix. It stays on your credit for 10 years. Talk to a nonprofit credit counselor first. They can help you weigh your options.

How to Avoid This in the Future

The best way to avoid repossession is to never get into a loan you can’t afford. But if you’re already in one:- Never let your payment be late. Even one day.

- Set up autopay with a backup payment method.

- Keep your car insured. Lenders require it. If you cancel, they can repossess.

- Track your car’s value. Use Kelley Blue Book or Edmunds. If your loan balance is rising faster than your car’s value, you’re in danger.

- Have a backup plan. If you lose your job, know what you’ll do before you miss a payment.

There’s no shame in asking for help. Thousands of people in Fort Collins, Denver, and across the country are in the same spot. The difference between those who recover and those who don’t? They acted before it was too late.

Can a lender repossess my car on a weekend?

Yes. Repossessions can happen any day of the week, including weekends and holidays. Lenders don’t follow your schedule. They operate 24/7. If your car is parked in a public area and accessible, they can take it anytime.

Will I get a notice before my car is repossessed?

In most states, no. Lenders are not legally required to warn you before taking your car. You might get a late payment reminder, but that’s not the same as a repossession notice. The first official notice usually comes after the car is already gone.

Can I go to jail for not paying my car loan?

No, you cannot go to jail for failing to pay a car loan. That’s a civil debt, not a criminal one. But if you lie to the court, hide your car to avoid repossession, or ignore a court order to appear, you could face contempt charges-which can lead to jail time.

How long do I have to get my car back after repossession?

Typically 10 to 30 days, depending on your state and lender. This is called the redemption period. After that, the lender can sell the car. Once it’s sold, you lose your right to get it back.

Does insurance cover repossession?

No. Auto insurance covers damage, theft, or accidents-not loan default. Repossession is a financial issue, not a risk covered by your policy. Even comprehensive insurance won’t help you keep your car if you stop paying.

What happens to my personal items in the car after repossession?

You have the right to retrieve your belongings. The lender must give you a list of what was taken and instructions on how to get it back. They can charge you a storage fee, but they can’t hold your things hostage. Call them as soon as possible-some items, like child seats or medications, may be removed quickly.

Patrick Sieber

November 16, 2025 AT 15:40Just called my lender after reading this. They offered me a 60-day forbearance with no penalty. No drama, no judgment. Just a human on the other end who said, 'We’ve seen this a hundred times this year.' Don’t wait until it’s too late. Call before you miss a payment. It’s that simple.

Kieran Danagher

November 17, 2025 AT 15:51Repossession agents don’t care if you’re a single mom working two jobs. They care about the contract. And yeah, they’ll take it while you’re at work. I’ve seen it. No warning. No mercy. Just a tow truck and a signature on a clipboard. You think you’re safe because you’ve never been late? That’s not luck. That’s ignorance.

OONAGH Ffrench

November 18, 2025 AT 21:15Debt is a social contract not a moral failure. The system is built to punish the desperate and reward the prepared. If you’re reading this because you’re scared you’re already ahead of most people. The rest are still scrolling past the fine print

poonam upadhyay

November 20, 2025 AT 17:17OMG I CAN’T BELIEVE PEOPLE STILL FALL FOR THIS!!! LENDERS ARE VAMPIRES!!! THEY’RE USING GPS TRACKERS TO HUNT YOU DOWN LIKE ANIMALS!!! AND THE GOVERNMENT LETS THEM!! WHY DO YOU THINK THEY PUSHED ‘FINANCIAL LITERACY’? IT’S A DISTRACTION TO MAKE YOU FEEL GUILTY WHILE THEY STEAL YOUR CAR WHILE YOU SLEEP!!!

Natasha Madison

November 21, 2025 AT 07:17They’re not just taking your car. They’re taking your dignity. I watched my neighbor’s truck get towed from the school parking lot while her kid was still inside. No warning. No apology. Just a guy in a hoodie with a clipboard. This isn’t capitalism. This is feudalism with a credit score.

Sheila Alston

November 21, 2025 AT 09:26People think they’re being smart by hiding their car. But you’re not outsmarting the system-you’re just making it worse. I’ve seen people get charged $1,200 in storage fees because they parked it in a friend’s garage for three weeks. Then they got sued for the deficiency. It’s not rebellion. It’s financial suicide.

Shivam Mogha

November 22, 2025 AT 11:30Call before you miss a payment. That’s all.

sampa Karjee

November 23, 2025 AT 11:34In India, we don’t have this problem because we don’t buy cars on credit like Americans. We save. We wait. We buy used. You people treat debt like a game. But debt doesn’t care about your feelings. It doesn’t care about your job loss. It doesn’t care that your kid needs a car seat. It only cares about the number. And when that number is late, they come for you. This isn’t a warning. It’s a lesson you should’ve learned in high school.