When you hear the term Crypto Liquidity Pool is a collection of tokens locked in a smart contract that enables trading on decentralized platforms without a traditional order book, it might sound like jargon. In plain language, it’s a pot of crypto that anyone can add to or pull from, and it powers the instant swaps you see on most DeFi sites. Understanding a crypto liquidity pool is the first step toward using or even creating one yourself.

Key Takeaways

- A crypto liquidity pool is a smart‑contract‑based vault of tokens that fuels decentralized trades.

- Automated Market Makers (AMMs) replace order books, pricing assets based on pool ratios.

- Liquidity providers earn fees and, often, extra token rewards through liquidity mining.

- Risks include impermanent loss, smart‑contract bugs, and network congestion.

- Different blockchains offer varied fee structures and TVL, so choose the one that fits your budget.

What Exactly Is a Crypto Liquidity Pool?

At its core, a Liquidity Pool stores two or more paired assets (like ETH and USDC) in a single smart contract. Traders don’t match with another person; they trade directly against the pool. The pool’s pricing algorithm automatically adjusts the price based on how much of each token remains after a swap. This model eliminated the need for a central exchange to hold order books, opening the door to truly peer‑to‑peer markets.

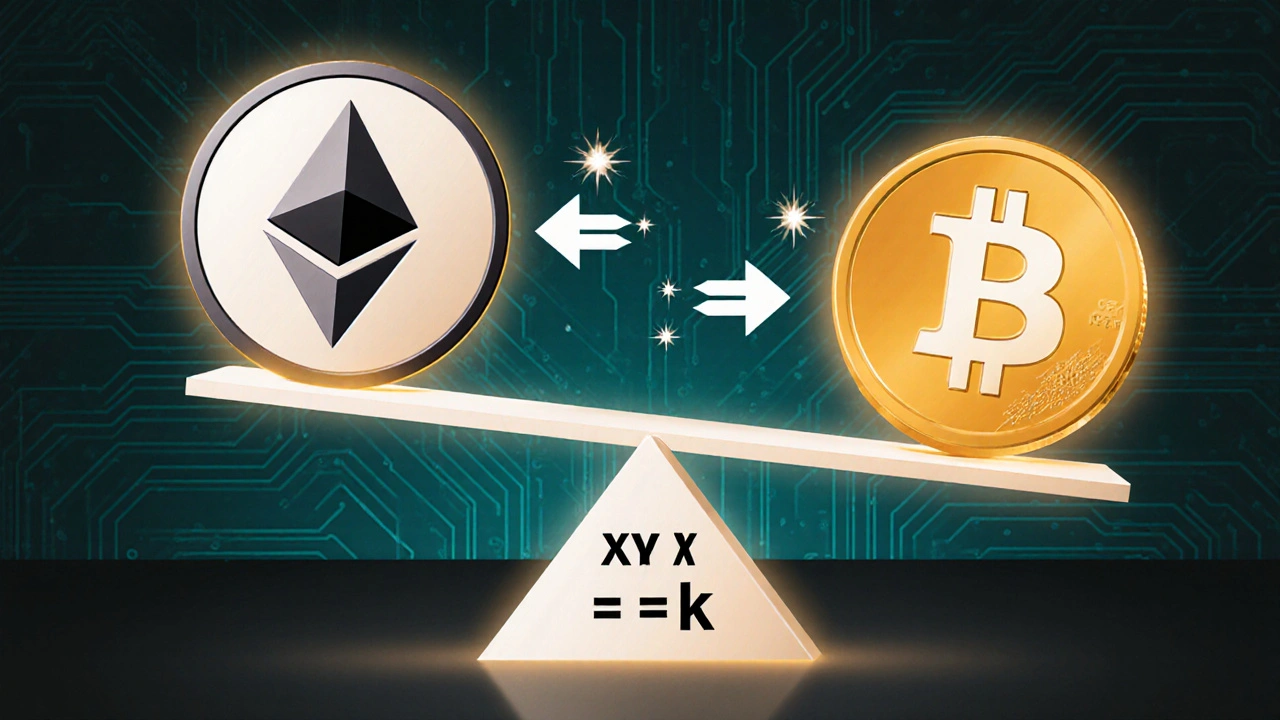

How Does an Automated Market Maker Work?

The engine behind most pools is an Automated Market Maker (AMM) that applies a mathematical formula-most commonly x·y = k-to keep the product of token reserves constant. When you buy ETH with USDC, the AMM reduces the USDC side and increases the ETH side, nudging the price upward. When you sell ETH back, the reverse happens, nudging the price down. This continuous balancing act ensures there’s always a price, even if no one is actively trading.

Who Supplies the Liquidity?

Anyone can become a Liquidity Provider (LP) by depositing an equal value of each token in a pool. In return, the protocol mints LP tokens that represent your share of the pool. Every time a trade occurs, a small fee-usually 0.2% to 0.3%-is split among all LPs proportionally. Many platforms also sprinkle extra rewards (often their native token) on top of those fees; this practice is called Liquidity Mining or yield farming, where users earn additional tokens for locking assets.

Step‑by‑Step: Adding Liquidity to a Pool

- Connect your wallet (MetaMask, Trust Wallet, etc.) to a Decentralized Exchange (DEX) like Uniswap or PancakeSwap.

- Select the token pair you want to fund, e.g., ETH/USDC.

- Enter the amount of each token you wish to deposit. The DEX will automatically calculate the required matching value.

- Confirm the transaction. Your wallet will pay a Gas Fee the network cost for executing the smart contract (cheaper on Binance Smart Chain than on Ethereum, typically).

- Receive LP tokens in your wallet. These can be staked in a farming contract for extra rewards or held to claim a share of trading fees.

Risks You Should Know About

Liquidity pools are powerful, but they aren’t risk‑free. The most talked‑about danger is impermanent loss. If the price of one token moves dramatically compared to its pair, the value of your pooled assets can dip below what you’d have if you simply held the tokens. The loss is “impermanent” because it can be recovered if prices revert, but it becomes permanent if you withdraw while the price gap remains.

Another risk is a buggy Smart Contract the self‑executing code that governs pool behavior. A vulnerability can be exploited, draining the pool’s funds. Always check whether the contract has been audited by reputable firms.

Finally, network congestion can inflate Gas Fees especially on Ethereum during high demand, eroding your returns. Some users migrate to lower‑fee chains like Binance Smart Chain or Polygon to mitigate this.

Comparing Liquidity Pools Across Blockchains

| Metric | Ethereum (Uniswap) | Binance Smart Chain (PancakeSwap) |

|---|---|---|

| Average Gas Fee (USD) | ≈ $12 | ≈ $0.15 |

| Total Value Locked (TVL) | ≈ $30B | ≈ $5B |

| Most Popular AMM | Uniswap v3 | PancakeSwap v2 |

| Typical LP APR (incl. farming) | 5‑20% | 10‑30% |

Ethereum offers deeper liquidity and a wider token selection, but the price you pay in gas can eat into modest returns. BSC’s lower fees boost net yields, yet the overall pool size is smaller, which can mean higher slippage for large trades. Your choice should match your trading volume, risk tolerance, and fee sensitivity.

Advanced Tips for Maximizing Returns

- Concentrated Liquidity: Uniswap v3 lets LPs allocate capital to specific price ranges, increasing fee earnings per dollar of capital.

- Cross‑Chain Yield Farming: Use bridging services to move assets to the chain offering the highest APR, but factor in bridge fees.

- Rebalance Regularly: Monitor your pool’s token ratio; re‑deposit or withdraw to keep the value split close to 50/50 and curb impermanent loss.

- Audit First: Only provide liquidity to contracts that have passed rigorous third‑party audits (e.g., Certik, Trail of Bits).

Frequently Asked Questions

What is the difference between a liquidity pool and a traditional order book?

A traditional order book matches buyers and sellers directly, requiring both sides to be present at the same time. A liquidity pool, powered by an AMM, always offers a price because the smart contract holds the assets. This means instant trades, no need for counterparties, and continuous pricing.

How are fees distributed to liquidity providers?

Whenever a swap occurs, the protocol takes a pre‑set fee (e.g., 0.3%). The fee is deposited back into the same pool, increasing its total value. LPs own a proportional slice of the pool via their LP tokens, so they automatically claim a share of the accumulated fees.

Can I withdraw my liquidity at any time?

Yes. LP tokens are fully redeemable; you simply return them to the pool’s smart contract and receive the underlying assets plus any accrued fees. Keep in mind that exiting during a period of high price volatility may lock in impermanent loss.

What are the main security concerns?

Smart‑contract bugs, oracle manipulation, and rug pulls are the biggest threats. Always use pools that have undergone reputable audits and monitor community sentiment before committing large sums.

Is it worth providing liquidity on newer chains like Solana or Avalanche?

Newer chains often offer higher APRs to attract liquidity, but they may lack the deep TVL and audit history of Ethereum or BSC. Assess the trade‑off between potential rewards and the risk of unaudited code or lower user adoption.

Crypto liquidity pools have reshaped how we trade, earn, and think about money. By grasping the mechanics, weighing the risks, and picking the right chain, you can turn a simple token stash into a steady source of passive income.