Leasing a car doesn’t have to mean paying high monthly bills. If you’ve ever felt stuck with a lease payment that eats into your budget, you’re not alone. Many people don’t know there’s a way to slash those payments-sometimes by hundreds of dollars-without extending the term or upgrading to a cheaper car. The trick? Multiple Security Deposits (MSDs). It’s not a secret, but it’s rarely explained clearly. Here’s how it actually works, and how you can use it to pay less every month.

What Exactly Is a Multiple Security Deposit?

A Multiple Security Deposit is exactly what it sounds like: you pay extra money upfront-beyond the standard security deposit-to lower your monthly lease payment. It’s not a down payment, and it’s not a fee. It’s a refundable deposit that the leasing company holds onto, and in exchange, they reduce your monthly finance charge.

Think of it like this: when you lease a car, you’re paying interest on the vehicle’s depreciation. That interest rate is called the money factor. The more money you put down as a security deposit, the less risk the lender sees. So they lower that money factor. Each MSD typically reduces the money factor by 0.00008 to 0.00010. That might sound tiny, but over 36 months, it adds up fast.

Most lease agreements allow up to 10 MSDs. That means you could put down as much as $3,000 to $5,000 extra upfront (depending on your base payment) and cut your monthly payment by $50 to $150. And here’s the best part: you get every dollar back at the end of the lease-as long as the car is returned in good condition.

How MSDs Lower Your Payment (The Math)

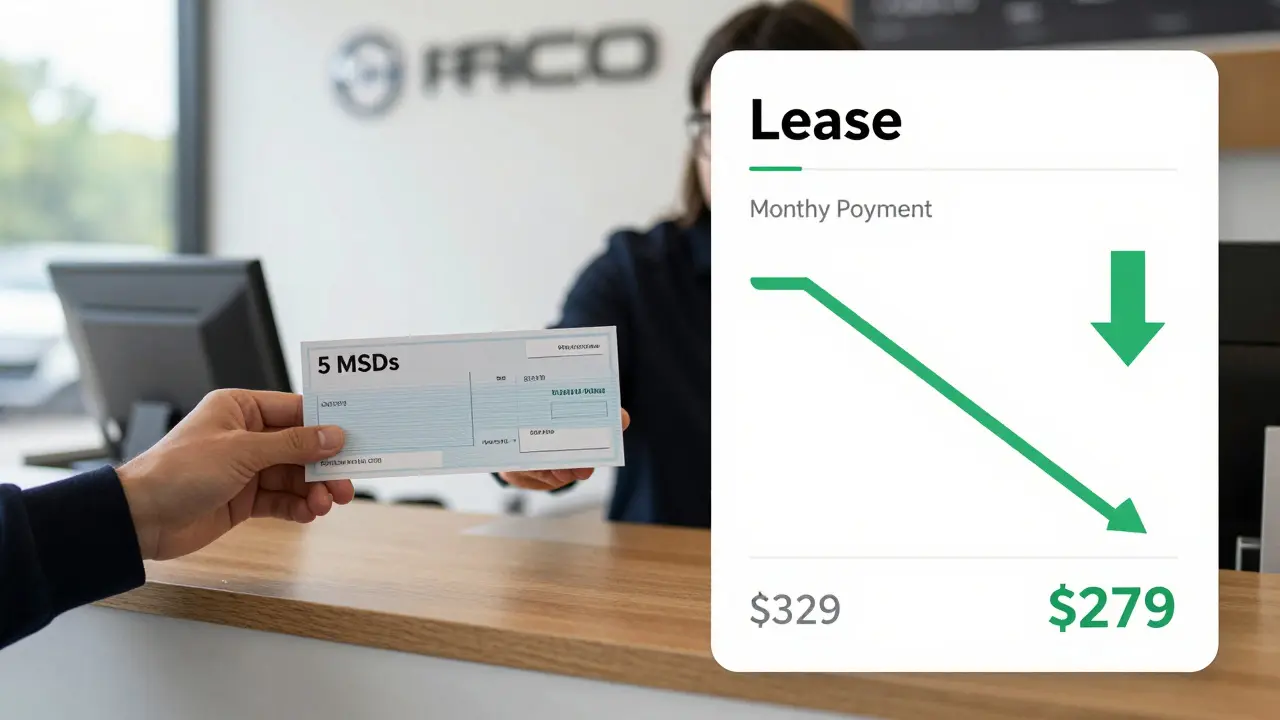

Let’s say you’re leasing a 2025 Honda Civic with a base monthly payment of $329. The money factor is 0.00175. You decide to put down 5 MSDs, each equal to your base payment: $329 × 5 = $1,645 total.

With 5 MSDs, the money factor drops by 0.0005 (5 × 0.0001). New money factor: 0.00125.

That change alone cuts your monthly payment to $279. You’re saving $50 a month. Over 36 months, that’s $1,800. You paid $1,645 upfront. So you come out ahead by $155-and you get your $1,645 back at the end of the lease.

That’s not a trick. That’s how the math works. The leasing company doesn’t earn as much interest because your deposit reduces their risk. You pay less interest, they still make money, and you walk away with cash in your pocket.

Who Benefits Most From MSDs?

MSDs work best for people who have the cash available upfront but want to keep their monthly expenses low. That usually means:

- People with steady income and emergency savings

- Those who plan to keep the car for the full lease term

- Drivers who don’t plan to exceed mileage limits

- Anyone who wants to avoid credit score penalties from high monthly payments

If you’re short on cash right now, MSDs aren’t for you. But if you’ve got $1,500 to $3,000 sitting in a savings account earning 0.5% interest, putting it toward an MSD gives you a guaranteed 6% to 12% annual return-because you’re effectively reducing your lease interest rate.

Compare that to a high-yield savings account. Most pay less than 1%. MSDs are one of the few financial moves in car leasing that actually give you a guaranteed, risk-free return.

How to Get MSDs on Your Lease

Not every dealer offers MSDs. Some brands, like BMW, Audi, and Mercedes-Benz, use them regularly. Others, like Hyundai and Kia, rarely do. Ford and Toyota are hit or miss-depends on the region and the finance company.

Here’s how to make sure you get them:

- Ask directly: “Do you offer Multiple Security Deposits to reduce my monthly payment?” Don’t wait for them to bring it up.

- Request the lease worksheet. Look for a line item labeled “MSD” or “Security Deposit Reduction.” If it’s not there, they’re not offering it.

- Confirm the money factor reduction per MSD. It should be clearly stated in writing.

- Make sure the refund policy is in the contract. It should say: “All MSDs are fully refundable at lease end, less any excess wear and tear or mileage charges.”

- Never pay MSDs in cash. Always use a check or bank transfer so you have a paper trail.

Dealers might try to push you toward a larger down payment instead. Don’t fall for it. A down payment reduces your payment but you don’t get it back. MSDs are refundable. That’s the difference.

What Happens at Lease End?

When your lease ends, the dealer inspects the car. If everything’s within normal wear and tear limits, and you’re under your mileage cap, you get every dollar of your MSDs back. No questions asked.

But if you’ve got a dent, excessive tire wear, or went 5,000 miles over your limit, they’ll deduct those costs from your refund. That’s standard. But here’s the catch: MSDs are refunded after all other charges are settled. So even if you owe $400 for scratches, you still get back $1,245 if you put down $1,645 in MSDs.

Keep your lease-end inspection checklist handy. Take photos before you return the car. Document everything. If they try to keep part of your MSDs unfairly, dispute it in writing. Most finance companies will reverse it if you have proof.

MSDs vs. Down Payments: The Real Difference

People confuse MSDs with down payments. They’re not the same.

| Feature | Multiple Security Deposit | Down Payment |

|---|---|---|

| Refundable? | Yes, if car is returned in good condition | No |

| Reduces monthly payment? | Yes, by lowering money factor | Yes, by reducing capitalized cost |

| Interest savings? | Yes, directly lowers finance charge | No, just reduces principal |

| Best for cash flow? | Yes-pay upfront, get it back | No-money is gone |

| Available on all leases? | No-ask your dealer | Yes-always an option |

MSDs are smarter because they’re like a low-interest loan you’re giving to the lender-and they pay you back with lower payments. A down payment is just money you give away.

When MSDs Don’t Make Sense

There are times when MSDs aren’t the right move:

- You don’t have the cash available. If putting down $2,000 means you can’t pay rent or cover an emergency, skip it.

- You plan to terminate early. If you think you’ll end the lease early, you might lose part or all of your MSDs.

- The money factor reduction is too small. Some dealers offer only 0.00002 reduction per MSD. That’s not worth it.

- You’re leasing a used car. MSDs are rare on certified pre-owned leases.

- The lease has a residual value that’s already too low. MSDs won’t fix a bad deal.

Always run the numbers. Ask the dealer for two quotes: one with MSDs and one without. Compare the total cost of ownership over the lease term. If the MSD version saves you money and you’re confident you’ll return the car in good shape, go for it.

Real-World Example: A 2025 Toyota Camry Lease

A customer in Ohio leased a 2025 Toyota Camry LE with a 36-month term, 12,000 miles/year, and a base payment of $289. The money factor was 0.00165.

They put down 7 MSDs ($289 × 7 = $2,023). The money factor dropped to 0.00095. New monthly payment: $228.

Monthly savings: $61. Total savings over 36 months: $2,196.

They got $2,023 back at lease end, minus $140 for a small scratch. Net gain: $2,056. That’s a 101% return on their upfront cash.

They didn’t need to make extra payments. They didn’t need to trade in early. They just used a tool most people never heard of-and saved money without sacrificing anything.

Final Tip: Ask for It Early

Don’t wait until the last minute to ask about MSDs. Dealers won’t mention them unless you do. And if you wait until signing day, they’ll say it’s too late.

Start your lease search by asking: “Do you offer Multiple Security Deposits?” If they say no, ask why. If they say it’s not available, try another dealer. Some brands have corporate policies that allow MSDs, but individual dealers ignore them.

Use MSDs like a negotiation tool. You’re not asking for a favor-you’re asking for a standard financial option that’s designed to benefit you.

Leasing a car shouldn’t feel like a financial trap. With MSDs, you’re not just paying less-you’re taking control of the terms. And that’s how smart drivers save money.

Are Multiple Security Deposits the same as a down payment?

No. A down payment reduces the car’s capitalized cost and is not refundable. Multiple Security Deposits (MSDs) reduce your monthly payment by lowering the money factor, and they are fully refundable at the end of the lease if the car is returned in good condition.

How many MSDs can I use on a lease?

Most leases allow up to 10 MSDs, but the exact number depends on the lender. Each MSD is usually equal to your base monthly payment. Some lenders cap the total MSD amount at 90% of the capitalized cost.

Do MSDs affect my credit score?

No. MSDs are not reported to credit bureaus. They’re treated as a security deposit, not a loan or credit extension. Your credit score isn’t impacted by paying or receiving MSDs.

Can I use MSDs on a used car lease?

Rarely. Most certified pre-owned (CPO) leases don’t offer MSDs because the residual values and money factors are already set differently. MSDs are mostly available on new car leases.

What if I end my lease early? Do I lose my MSDs?

Yes. If you terminate your lease early, the lender will keep your MSDs to cover early termination fees and lost interest. MSDs are only refundable if you complete the full lease term and return the vehicle in good condition.

Do all car brands offer MSDs?

No. Brands like BMW, Audi, and Mercedes-Benz commonly offer MSDs. Toyota, Honda, and Hyundai sometimes do, depending on the region and finance company. Always ask before signing.

Can I stack MSDs with other incentives?

Yes. MSDs can be combined with manufacturer rebates, loyalty discounts, and conquest offers. Just make sure the dealer applies the rebate to the capitalized cost, not the MSD amount.

How do I know if the MSD reduction is fair?

A typical MSD reduces the money factor by 0.00008 to 0.00010 per deposit. If a dealer offers less than 0.00005 per MSD, it’s not worth it. Always request the lease worksheet to verify the money factor change.

Richard H

December 17, 2025 AT 23:42This is the kind of financial hack that makes me sick-people with cash sitting around like it’s Monopoly money get to play banker with their lease payments while the rest of us are stuck paying $400/month just to get to work. You call this smart? It’s just privilege with a spreadsheet.

Kendall Storey

December 19, 2025 AT 15:30MSDs are the unsung hero of lease optimization. You’re essentially fronting capital to reduce the lender’s risk premium-same as how bond yields drop with higher collateral. The money factor reduction is linear, so 5 MSDs = 0.0005 drop, not compound. Crunch the numbers on the lease worksheet before signing. Pro tip: Always request the APR equivalent-it’s easier to compare than the money factor. 0.00125 MF = ~3.0% APR. That’s cheaper than most credit cards.

Pamela Tanner

December 21, 2025 AT 11:11I appreciate how clearly this is explained. Many people confuse security deposits with down payments, and that misunderstanding costs them thousands. MSDs are a legitimate, refundable tool-not a trick, not a scam. If you have the liquidity, it’s one of the few lease maneuvers that actually generates positive net cash flow. Just make sure the contract explicitly states ‘fully refundable upon return in good condition.’ And keep photos. Always.

Kristina Kalolo

December 21, 2025 AT 22:48So if I put down $2,000 in MSDs and get it all back, but save $60/month for 36 months, that’s $2,160 in savings-so I make $160 net? But what if the car gets a scratch I didn’t notice? Do they deduct from the MSD before the security deposit? Or is the MSD separate?

ravi kumar

December 23, 2025 AT 22:15Good info. I live in India and we don’t have this system here. But I see how powerful it is. For someone with steady income, this is like getting interest on your own money. I’ll share this with my cousin who’s leasing a car next month. He’s got the cash, just didn’t know this trick exists.

Megan Blakeman

December 25, 2025 AT 09:45This is so cool!! I’ve been leasing for years and never knew this existed!! I’m gonna go back and re-read this like 10 times. I have $2k sitting in my savings account and it’s literally doing nothing… what if I tried this?? I feel like a financial genius already just by reading this!! 😍

Akhil Bellam

December 25, 2025 AT 19:45Pathetic. You’re celebrating a 101% return on a $2,000 deposit? That’s not financial genius-that’s just avoiding the fact that you’re leasing a depreciating asset at all. Real wealth isn’t about squeezing $50/month out of a Toyota lease-it’s about buying a used Accord outright with cash and driving it for ten years. You’re not smart. You’re just desperate to feel smart.

Amber Swartz

December 26, 2025 AT 02:24Wait… so if I do this and they try to keep my deposit over a tiny scratch… I’m basically giving them $2k and hoping they don’t screw me? What if they lie? What if the inspector is corrupt? What if the dealership goes bankrupt and my money vanishes? This feels like a trap. I’m not trusting my hard-earned cash to some faceless finance company. This is how people get robbed.

Robert Byrne

December 26, 2025 AT 04:04That’s not how the math works. You said the money factor drops by 0.0001 per MSD, but in your example you used 0.0001 × 5 = 0.0005, which is correct. But then you say the new payment is $279. That’s wrong. You need to recalculate the entire lease payment using the adjusted money factor and the same capitalized cost. You’re not accounting for residual value correctly. Your $155 net gain is inflated. This post is misleading.

Tia Muzdalifah

December 27, 2025 AT 02:24omg i had no idea this was a thing!! i thought all leases were just ripoffs 😭 i live in california and my dealer said no down payment options but maybe if i ask nicely?? i’ll try it next time i lease… thank u for sharing!!

Zoe Hill

December 27, 2025 AT 18:47thank you for this!! i’ve been trying to figure out how to lower my lease payment without getting stuck with a car i can’t afford… i’m gonna print this out and take it to the dealership!! i hope they don’t think i’m weird for asking 😅

Albert Navat

December 29, 2025 AT 11:24You’re missing the real play here. MSDs are only available if the finance company is owned by the automaker-so it’s not about the dealer, it’s about the captive lender. BMW FS, Mercedes-Benz Financial, Audi Financial-they all do it. Toyota Financial? Nope. Not because they’re cheap, but because they don’t want you to optimize your lease. They want you to pay more. This isn’t a loophole-it’s a corporate strategy to extract more from the uninformed.

King Medoo

December 29, 2025 AT 11:46Let me be clear: this is the kind of financial manipulation that makes me sick. 🤢 You’re telling people to hand over $2,000 to a bank that will profit either way. You call it a ‘guaranteed return’? Nah. It’s a psychological trap. You’re not saving money-you’re just delaying the pain. And when you get that $2,000 back, you’ll spend it on a new phone or a vacation. Meanwhile, the bank earned interest on your cash for 3 years. 😎💸 You think you’re winning? You’re just the mark who thinks they’re clever. This isn’t financial freedom. It’s financial gaslighting.

Rae Blackburn

December 30, 2025 AT 17:31They’re lying. This is a scam. MSDs don’t exist. The government hides them. The banks don’t want you to know. If you ask for MSDs, they’ll say ‘no’ and then charge you $1,200 in ‘documentation fees.’ I know someone who did this. They lost $3,000. They’re still in therapy. Don’t trust dealers. Don’t trust leases. Don’t trust this post. The system is rigged.