Buying a car shouldn’t feel like stepping into a maze with no map. Yet too many people sign papers without reading them, accept vague promises about "lifetime coverage," and later realize they’re stuck with a lemon and no way out. The truth? The real protection doesn’t come from the salesperson’s smile-it comes from what’s written down. Contracts, warranties, and legal safeguards are your armor. Skip them, and you’re driving blind.

What’s in the Contract? Don’t Just Sign It

The vehicle purchase agreement isn’t a formality. It’s the only legally binding record of what you’re getting. Every price, every feature, every promise must be in writing. Verbal guarantees? Worthless in court. I’ve seen buyers walk away thinking they got a "free maintenance package"-only to find out the dealer meant two oil changes, not five years of service.

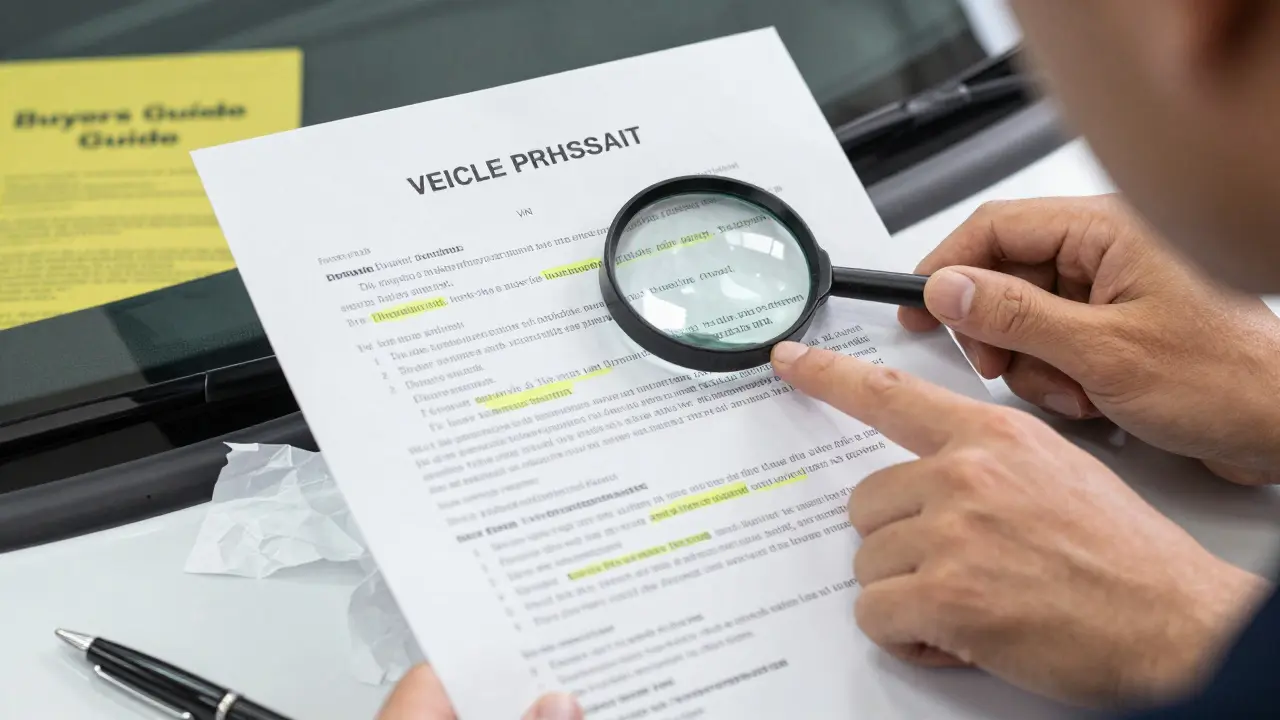

Check these five things before signing:

- Final price: Does it include taxes, fees, and documentation charges? Some dealers hide $1,500 in fees under "administrative costs."

- Vehicle identification number (VIN): Match it to the title and the car’s dashboard. A mismatch means you could be buying a stolen or salvaged vehicle.

- Trade-in value: If you’re trading in your old car, the agreed amount must be listed. No "subject to inspection" loopholes.

- Optional add-ons: Extended warranties, rustproofing, paint protection-these are often marked up 300%. If you didn’t ask for it, it shouldn’t be on the contract.

- Delivery date: If the car isn’t ready by the date listed, you’re entitled to a refund or alternative.

Walk away if anything’s blank, crossed out, or handwritten. Dealers sometimes leave spaces for later fill-ins. That’s not a typo-it’s a trap.

Warranties: What’s Covered and What’s Not

Warranties are where most buyers get fooled. The term "factory warranty" sounds solid, but it’s not magic. Most new cars come with a 3-year/36,000-mile bumper-to-bumper warranty and a 5-year/60,000-mile powertrain warranty. That means the engine, transmission, and drivetrain are covered-but not your touchscreen, AC compressor, or door locks.

Used cars are trickier. A "certified pre-owned" (CPO) vehicle from a manufacturer like Toyota or Honda usually includes a 12-month/12,000-mile warranty on top of any remaining factory coverage. But a dealership-only warranty? Read the fine print. Many exclude:

- Wear-and-tear items: brakes, tires, batteries

- Electrical systems: infotainment, sensors, wiring

- Damage from neglect: low oil, missed oil changes, off-roading

Extended warranties sold at the dealership? They’re profit centers. The average cost is $2,000. The average payout? $800. That’s not insurance-it’s a gamble. Only consider one if:

- You’re buying a car with a known reliability issue (like certain Ford EcoBoost engines)

- The warranty is transferable and backed by the manufacturer, not a third-party provider

- You’re keeping the car past 100,000 miles

Always ask: "Is this warranty backed by the automaker or a third-party administrator?" If it’s the latter, check their financial rating. Some are shell companies with no assets.

State Laws Are Your Secret Weapon

Every state has lemon laws, but New York’s are among the strongest. If your new car has a defect that can’t be fixed after four repair attempts-or if it’s been in the shop for 30 days within the first two years or 18,000 miles-you’re entitled to a refund or replacement. You don’t need a lawyer to start the process. Just send a certified letter to the manufacturer with your repair records.

For used cars, New York’s Used Car Lemon Law applies to vehicles under 100,000 miles sold by dealers (not private sellers) with a 60-day/3,000-mile warranty. If a major component fails during that window, the dealer must fix it. If they can’t, you can cancel the sale and get your money back.

Don’t forget the FTC’s Used Car Rule. By law, every used car dealer must display a yellow Buyers Guide on the window. It tells you:

- Whether the car is sold "as-is" or with a warranty

- What’s covered under that warranty

- Who pays for repairs

If the guide is missing, or it says "as-is" but the salesperson promised a warranty, you have legal standing. Record the conversation. Take photos. That yellow sticker is your proof.

Red Flags That Mean Walk Away

Some dealers rely on buyer ignorance. Watch for these signs:

- "We can’t give you the title today": That’s a classic sign of a title loan scam or a car with a lien you don’t know about.

- "This is our best price-today only!": Pressure tactics mean they expect you to skip due diligence.

- "We don’t do refunds": All sales are final? That’s illegal in New York if the car has undisclosed damage.

- Missing service records: A used car without maintenance history is a gamble. Ask for Carfax or AutoCheck. If they refuse, walk.

- Payment in cash only: Legitimate dealers use bank transfers or checks. Cash transactions leave no paper trail.

One client bought a 2020 Honda Civic for $18,500. The dealer said it had "new brakes and tires." The contract didn’t mention it. Three weeks later, the brakes failed. No warranty covered it. No proof existed. She lost $3,000 in repairs. All because she trusted the salesperson over the paper.

Protect Yourself Before You Drive Off

Here’s your checklist before signing anything:

- Get a pre-purchase inspection from an independent mechanic-$100-$150, but worth it.

- Request the vehicle’s full service history and title status from the DMV.

- Read every line of the contract. If you don’t understand it, ask for a copy to take home.

- Confirm the Buyers Guide is present and accurate on a used car.

- Never pay a deposit without a written receipt that includes a refund policy.

- Keep a folder with: contract, warranty documents, inspection report, payment receipts, and communication logs.

Most people think protection comes from the warranty sticker on the window. It doesn’t. It comes from the paper trail. The more you document, the less power the dealer has to wiggle out of their promises.

What Happens When Things Go Wrong?

Let’s say your car breaks down a month after purchase. Here’s what to do:

- Call the dealership or warranty provider immediately. Document the call-date, time, name, what was said.

- Get a written estimate for repairs. Don’t let them start work without your approval.

- If they refuse to fix it under warranty, send a certified letter demanding action. Keep copies.

- If still no resolution, file a complaint with the New York State Attorney General’s Office. They handle auto fraud cases daily.

- For new cars, contact the manufacturer’s regional office. They often step in to avoid bad publicity.

Don’t wait. The clock starts ticking the moment you drive off the lot. Lemon laws have strict deadlines. Missing one can cost you thousands.

Can I cancel a car contract after signing in New York?

In New York, there’s no general "cooling-off" period for car purchases. Once you sign, the deal is final-unless the contract includes a cancellation clause (rare) or the dealer committed fraud (like hiding accident history). If you believe you were misled, contact the NY Attorney General’s Office immediately. They may help you rescind the sale.

What’s the difference between a factory warranty and an extended warranty?

A factory warranty comes from the carmaker and is included with new vehicles. It’s backed by the manufacturer’s reputation and finances. An extended warranty is sold separately, often by the dealer or a third party. It may have stricter limits, higher deductibles, and less reliable claims handling. Factory warranties are far more trustworthy.

Do I need a lawyer to buy a car?

No, you don’t need a lawyer to buy a car. But you should read the contract carefully and ask questions. If something feels off-like hidden fees, vague warranty terms, or pressure to sign quickly-consult a consumer protection attorney. Many offer free initial consultations. It’s cheaper than fixing a bad deal later.

Can I get a refund if the car has undisclosed damage?

Yes-if the damage was known to the dealer and not disclosed, it’s fraud. In New York, dealers must disclose major accidents, flood damage, or salvage titles. If they didn’t, you can demand a refund. Gather photos, repair estimates, and any communication that shows they knew. File with the Attorney General’s Office.

Is a "certified pre-owned" car always better than a regular used car?

Not always. CPO cars come with manufacturer-backed warranties and inspections, which is good. But they’re often priced $3,000-$7,000 higher than similar non-CPO models. If the car has low mileage and a clean history, a well-inspected regular used car might be a better value. Always check the CPO warranty terms-it’s not the same across brands.

If you’re buying a car, treat it like a legal transaction-not a handshake deal. The best protection isn’t a sticker on the window. It’s the document you read, the questions you ask, and the paper trail you keep.

Steven Hanton

January 23, 2026 AT 18:58Really appreciate this breakdown. I bought my last car without reading the contract and ended up paying $1,200 for an extended warranty I never wanted. Never again. Now I print everything out and read it with a highlighter. If it’s not in writing, it doesn’t exist.

Pamela Tanner

January 24, 2026 AT 20:06Excellent guide. One addition: always verify the VIN with the DMV before signing. I once saw a buyer get stuck with a car that had been in a major flood-the dealer had altered the title paperwork. Paper trail saves lives.

Kristina Kalolo

January 25, 2026 AT 10:47Factories don’t cover infotainment systems? That’s wild. My 2021 Camry’s touchscreen died at 28k miles. Warranty said no. I had to pay $900 out of pocket. This article nailed it.

ravi kumar

January 25, 2026 AT 10:56As someone from India, I never realized how much legal protection exists in the U.S. car market. Here, you sign and pray. This post opened my eyes. Thank you.

Megan Blakeman

January 26, 2026 AT 18:03OMG, YES. I had a dealer tell me "it’s covered" and then laugh when I asked for it in writing. I cried for three days after the transmission died. I’m so glad someone finally said this out loud. Please, please, please read the contract. I beg you.

Akhil Bellam

January 26, 2026 AT 21:15Most people are sheep. They trust smiles. They don’t read. They think "certified" means "perfect." Newsflash: CPO is just marketing. The dealer still makes 20% profit on every extended warranty. You’re not buying protection-you’re buying their retirement fund.

Amber Swartz

January 27, 2026 AT 01:09I bought a car last year and the dealer said "we don’t do refunds." I didn’t know that was illegal in NY. I went to the AG’s office and they forced the dealer to take it back. I got my money back, plus $500 for emotional distress. If you’re being screwed-DON’T SIT THERE. FIGHT BACK.

Robert Byrne

January 28, 2026 AT 13:39Stop letting dealers treat you like a sucker. If they refuse to let you take the contract home? Red flag. If they say "everyone signs this"? They’re lying. You’re not obligated to sign on the spot. Walk out. I’ve done it three times. Got better deals every time. Stop being polite. Be ruthless.

Tia Muzdalifah

January 28, 2026 AT 19:05lol i just realized i never checked the buyers guide on my last car… and now i’m kinda panicking. but like, i did get a pre-purchase inspection so maybe i’m okay? 🤞

Zoe Hill

January 30, 2026 AT 15:17Thank you for this!! I’m so glad I read this before signing. I asked for the service history and they said "we don’t have it"-so I walked. Found a better car with full records two days later. Paper trail = peace of mind.

Albert Navat

January 31, 2026 AT 00:03Let’s be real-the only way to win is to buy a Tesla. No dealer BS, no extended warranties, no hidden fees. Everything’s digital, transparent, and backed by the company. If you’re still buying gas cars from a dealership in 2025, you’re playing on hard mode.