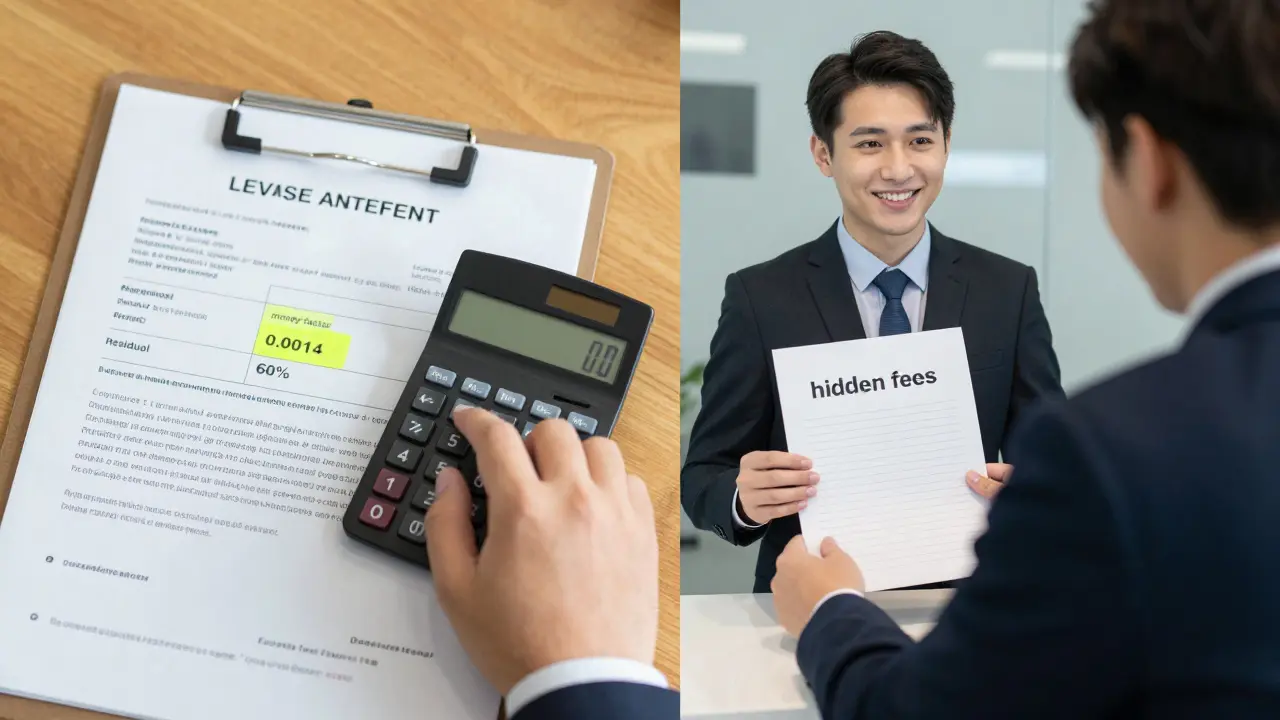

Leasing an SUV sounds simple: drive a new vehicle, pay monthly, return it after a few years. But the real cost? It’s hidden in three numbers: residuals, money factors, and incentives. Skip understanding these, and you could overpay by thousands-even if the monthly payment looks great.

What Residual Value Really Means

Residual value is the estimated worth of your SUV at the end of the lease. It’s not random. Automakers and leasing companies use historical data, demand trends, and depreciation rates to set it. For example, a 2025 Honda CR-V might have a 62% residual after 36 months. That means if the MSRP is $35,000, the car is projected to be worth $21,700 at lease end.

Why does this matter? Higher residual = lower monthly payment. Why? Because you’re only paying for the depreciation. If the residual is too low, you’re paying for more of the car’s value loss. That’s why some SUVs like the Toyota RAV4 and Subaru Outback hold their value so well-they have residuals above 60% even after three years.

Low residuals? That’s usually a red flag. It means the car is expected to drop in value fast. Maybe it’s a new model with unproven reliability, or it’s from a brand with weak resale demand. Always ask: What’s the projected residual? Don’t take the salesperson’s word-ask for the lease worksheet.

Money Factor: The Hidden Interest Rate

Think of the money factor as the lease version of an interest rate. But it’s not labeled that way. It’s a tiny decimal, like 0.00185. To convert it to an annual percentage rate (APR), multiply by 2,400. So 0.00185 × 2,400 = 4.44% APR.

Why not just say APR? Because leasing companies want to obscure the true cost. A money factor of 0.0025 might look small, but that’s 6% APR-higher than most car loans. Credit score matters here. If you have excellent credit (750+), you’ll often get money factors under 0.0012, which is under 3% APR. If your score is below 680, you could be looking at 0.0025 or higher.

Always ask: What’s my money factor? And compare it to current auto loan rates. If the lease APR is higher than what you’d pay financing the same SUV outright, you’re not getting a deal-you’re just paying more over time.

Incentives: The Secret Discount That Changes Everything

Lease incentives aren’t just “$1,000 off.” They’re often hidden in the residual, the money factor, or as a cash rebate. For example, in early 2026, the Ford Edge had a $3,500 lease cash incentive. That’s not applied to the sticker price-it’s subtracted from the capitalized cost before the lease calculation even starts.

Some manufacturers offer dealer-only incentives. That means the dealer might not tell you unless you ask. Others give loyalty bonuses-$500 extra if you’re leasing again from the same brand. Or manufacturer-to-consumer rebates tied to specific models, like the Hyundai Tucson getting $2,000 in lease cash just for choosing the SEL trim.

Check manufacturer websites directly. Don’t rely on dealerships. Go to Ford.com, Hyundai.com, or Toyota.com, find the lease section, and filter by SUV. You’ll see real-time incentives. If a dealer says “no incentives,” they’re either lying or not checking properly.

How to Calculate Your True Monthly Payment

Here’s the formula leasing companies use-but you can do it yourself:

- Net Capitalized Cost = MSRP - Down Payment - Incentives

- Depreciation Fee = (Net Cap Cost - Residual Value) ÷ Lease Term (in months)

- Finance Fee = (Net Cap Cost + Residual Value) × Money Factor

- Total Monthly Payment = Depreciation Fee + Finance Fee + Sales Tax

Example: 2025 Kia Sportage, MSRP $32,000, $2,000 incentive, 0% down, 36-month lease, 60% residual, money factor 0.0014.

- Net Cap Cost = $32,000 - $2,000 = $30,000

- Residual = $32,000 × 0.60 = $19,200

- Depreciation Fee = ($30,000 - $19,200) ÷ 36 = $300

- Finance Fee = ($30,000 + $19,200) × 0.0014 = $68.88

- Total Before Tax = $300 + $68.88 = $368.88

With 7% sales tax? Add $25.82. Final payment: $394.70. Now compare that to the dealer’s quote. If they say $410, they’re hiding something.

What SUVs Have the Best Lease Deals Right Now?

As of February 2026, these SUVs are offering the strongest combinations of high residuals, low money factors, and big incentives:

| Model | Residual (%) | Money Factor | Lease Incentive | Monthly Payment (36 mo, 10k/mi) |

|---|---|---|---|---|

| Toyota RAV4 | 65% | 0.00110 | $1,500 | $325 |

| Honda CR-V | 63% | 0.00105 | $2,000 | $310 |

| Hyundai Tucson | 61% | 0.00095 | $3,000 | $295 |

| Kia Sportage | 60% | 0.00140 | $2,500 | $315 |

| Ford Escape | 58% | 0.00160 | $3,500 | $330 |

Notice how Hyundai and Honda lead? High residuals + low money factors + big cash incentives = unbeatable numbers. The Ford Escape has the biggest incentive, but its lower residual and higher money factor mean it’s not the best value overall.

Red Flags in Lease Offers

Here’s what to watch for:

- “No money down” sounds great, but it raises your monthly payment. You’re rolling the down payment into the lease.

- Excess mileage fees of $0.25 per mile or more are common. If you drive 15,000 miles a year, you’ll pay extra unless you negotiate higher limits upfront.

- Disposition fees of $350-$500 are standard, but some brands waive them. Ask.

- Wear-and-tear charges for minor scratches or worn tires. Get the inspection guidelines before signing.

- Extended warranties sold at lease end. You don’t need them. The factory warranty usually covers the full term.

Should You Lease or Buy?

Leasing makes sense if you:

- Drive less than 12,000 miles a year

- Like driving a new SUV every 2-3 years

- Want lower monthly payments and minimal maintenance costs

Buy if you:

- Drive more than 15,000 miles a year

- Keep cars 7+ years

- Want to build equity and avoid end-of-lease fees

Leasing isn’t a waste. It’s a smart financial tool-if you understand the numbers. Buying gives you long-term value. Leasing gives you short-term control. Choose based on your habits, not the monthly payment alone.

What to Do Next

Don’t walk into a dealership without this:

- Know your credit score

- Check manufacturer websites for current incentives

- Calculate the payment yourself using the formula

- Ask for the lease worksheet before signing

- Compare at least 3 dealerships

If a dealer says, “This is the best deal,” walk out. There’s always a better one. Leasing is competitive. The market moves fast. February 2026 is a great time to lock in low money factors and big incentives-before they disappear.

Are SUV lease deals better than sedan lease deals right now?

Yes, in early 2026, SUVs are offering more competitive lease deals than sedans. Demand for SUVs remains high, and manufacturers are using bigger incentives to move inventory. Sedans like the Honda Accord and Toyota Camry still have good leases, but SUVs like the Hyundai Tucson and Honda CR-V are offering lower money factors and higher residuals. SUVs also tend to hold value better, making them more attractive for leasing.

Can you negotiate the residual value on a lease?

No, you cannot negotiate the residual value. It’s set by the leasing company based on industry data and projected depreciation. But you can choose a different model or trim level that has a higher residual. For example, a base model SUV might have a 58% residual, while the top trim has 63%. Picking the higher-residual option lowers your monthly payment even if the sticker price is higher.

Is a 0.00100 money factor good?

Yes, a money factor of 0.00100 is excellent. It converts to a 2.4% APR, which is lower than most new car loan rates. This typically only happens for buyers with excellent credit (750+) on models with high demand and strong residuals. If you’re offered this, lock it in. It’s a rare deal.

Do lease incentives apply to all trims?

Not always. Many lease incentives are trim-specific. For example, a $3,000 incentive might only apply to the base or mid-level trim, not the top-tier model. Always check the manufacturer’s website for exact eligibility. Sometimes, the highest trim has a better residual, making it a better overall deal even without the cash incentive.

What happens if I exceed my mileage limit?

You pay a per-mile fee-usually between $0.15 and $0.25 per mile over your limit. If you go 18,000 miles a year on a 12,000-mile lease, you’ll pay $9,000 extra at the end. That’s more than a full year’s payment. If you know you’ll drive more, negotiate a higher limit upfront. It costs less per mile than paying after the fact.

Frank Piccolo

February 7, 2026 AT 16:15Let’s be real - most people don’t even know what a money factor is, and they’re signing leases like it’s a lottery ticket. I’ve seen guys walk out of dealerships thinking $300/month is a ‘deal’ while the residual was 55% and the money factor was 0.0028. That’s 6.7% APR. On a lease. With a 36-month term. You’re basically financing the whole damn car and paying extra for the privilege. And don’t get me started on ‘incentives’ that disappear when you ask for the worksheet. Dealers are sharks in polo shirts.

James Boggs

February 9, 2026 AT 05:44Thank you for this clear breakdown. I’ve been leasing for years but never understood the math behind it. This makes it feel less like a black box and more like a fair transaction. I’ll be printing this out for my next lease negotiation.

Abert Canada

February 9, 2026 AT 21:12As a Canadian, I’ve noticed our lease deals are way worse than the US. Same models, same manufacturers, but residuals are lower, money factors are higher, and incentives? Ha. We get crumbs. I leased a Tucson last year - $410/month with $1,200 incentive. In the US, it was $290. It’s not even close. Maybe we need a national lease transparency law. Or at least a boycott.

Xavier Lévesque

February 11, 2026 AT 03:31Wow. A post that doesn’t end with ‘subscribe for more!’ or ‘DM for the spreadsheet.’ Revolutionary. Also, the Hyundai Tucson at $295? That’s not a lease. That’s a government handout. Someone’s gonna get fired for this deal.

Rakesh Kumar

February 13, 2026 AT 02:39Bro this is the most useful thing I’ve read all year! I was about to sign a lease on a Ford Escape thinking I got a steal - $330/month sounds cheap right? But now I see the residual is 58% and money factor is 0.0016? That’s a trap! I’m going back to the dealer tomorrow with this page open on my phone. Thank you from Mumbai!

Bill Castanier

February 14, 2026 AT 21:05Correct. Always request the lease worksheet. Always. The numbers are there. The math doesn’t lie. The dealer does.

Ronnie Kaye

February 15, 2026 AT 08:59Let me guess - the person who wrote this is either a finance bro who leases 3 cars a year or a dealership employee trying to look helpful. Either way, you’re still getting taken. The ‘best deals’ are only available to people with 800+ credit scores who show up with cash in hand. Everyone else? They’re just paying for the illusion of a good deal.

Priyank Panchal

February 17, 2026 AT 03:58You say ‘always ask for the worksheet.’ But in India, no dealer even knows what that is. They hand you a glossy brochure with ‘$0 down’ and ‘low monthly’ in 14-point font. The real numbers? Hidden in a PDF no one can open. This guide is useless here. We need a global lease transparency movement.

Ian Maggs

February 19, 2026 AT 00:03The notion that leasing is ‘smart’ if you drive under 12,000 miles annually presumes that one’s life is predictable, stable, and devoid of change - which is, frankly, a bourgeois fantasy. What if you move cities? What if you have a child? What if you lose your job? Leasing is a contract with the future - and the future is, as we all know, a chaotic, unpredictable, and often cruel entity. Buy a car. Own it. Let it age with you. Let it accumulate scratches like wisdom.

Flannery Smail

February 19, 2026 AT 10:35Ugh. Another ‘leasers are smart’ post. Newsflash: leasing is just renting with more fees and no equity. You’re paying to drive someone else’s asset while they profit off your monthly payments. If you want a new car every 3 years, save up and buy used. It’s cheaper, more honest, and you won’t get charged $300 for a bent door handle.

Emmanuel Sadi

February 20, 2026 AT 00:51Wow. You really think people care about residuals? Most lease signers don’t even know what ‘MSRP’ stands for. They just see ‘$299/month’ and think they’re winning. This post is just a luxury for the financially literate. The rest of us? We’re just trying to get to work without a broken transmission. Stop pretending this is a game. It’s survival.

Nicholas Carpenter

February 21, 2026 AT 17:56This is incredibly helpful. I’ve been in the market for an SUV lease and was overwhelmed. Your breakdown of the formula and the real-world examples made it click. I’m going to use this as a checklist before I sign anything. Thank you for taking the time to explain it so clearly.

Chuck Doland

February 22, 2026 AT 21:42It is imperative to emphasize that the residual value, as articulated, is not merely an arbitrary figure, but rather a statistically derived projection grounded in longitudinal market analytics. Furthermore, the conversion of the money factor to an annual percentage rate - while mathematically straightforward - is frequently obfuscated by institutional obfuscation. The imperative for transparency, therefore, is not merely ethical, but epistemologically necessary. One must not rely on dealer assertions; one must demand documentation. The lease worksheet is not a courtesy - it is a right.

Madeline VanHorn

February 23, 2026 AT 15:57I just leased a CR-V. $310 a month. No down payment. I’m so smart.