Finance

When working with Finance, the system of managing money, assets, and risk in personal and business contexts. Also known as financial management, it drives every buying decision, investment plan, and savings habit. Finance encompasses a range of tools, from traditional banking to cutting‑edge crypto liquidity pools, which are reshaping how value moves online.

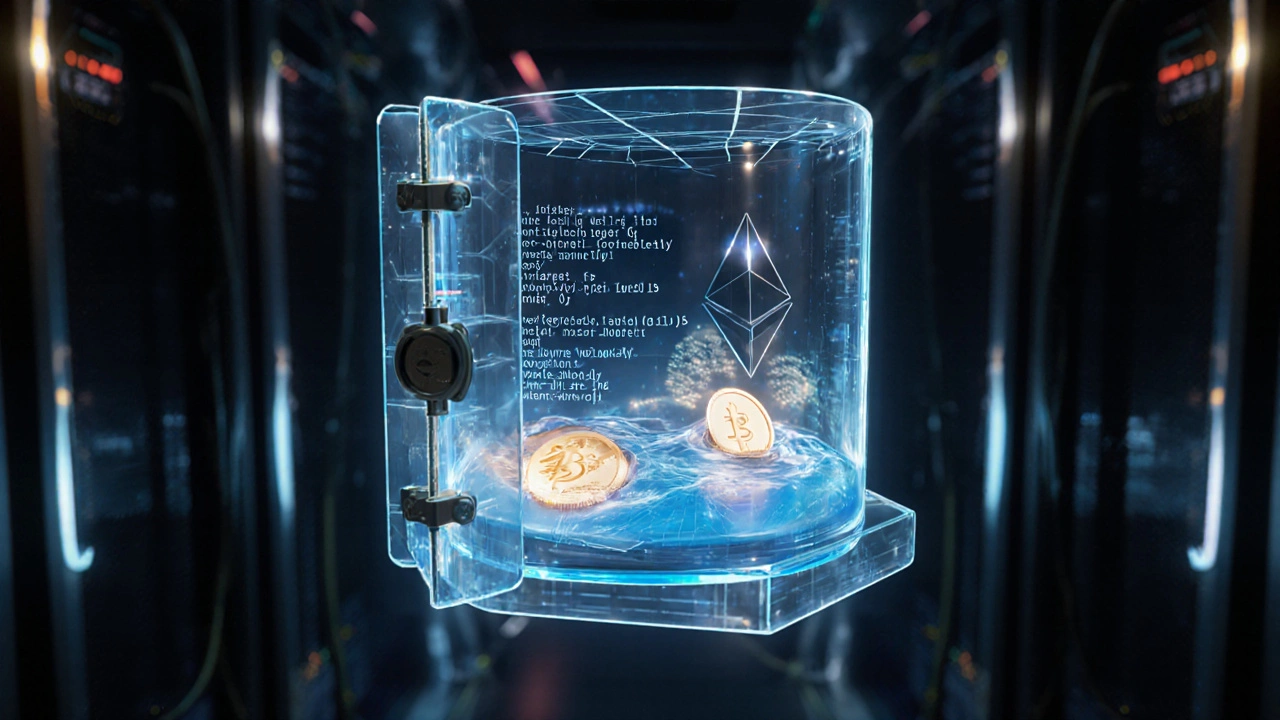

One of the hottest sub‑areas is the Crypto Liquidity Pool, a shared reserve of digital tokens that powers trades on decentralized platforms. These pools enable traders to swap assets instantly without a central order book. The concept sits at the heart of DeFi, decentralized finance that aims to recreate traditional services using blockchain technology. DeFi relies on automated market makers to keep these pools liquid and functional.

Key Players in Modern Finance

The Automated Market Maker, a smart‑contract algorithm that sets prices based on pool ratios is the engine behind most decentralized exchanges. By continuously adjusting prices, an AMM allows anyone to provide liquidity and earn transaction fees. This structure creates a self‑sustaining ecosystem where liquidity providers, traders, and developers all benefit. In practice, an AMM enables a Decentralized Exchange, a platform that lets users trade directly from their wallets without a middleman.

Understanding these pieces helps you see why Finance is no longer just about banks and stocks. It’s a network of protocols, incentives, and community‑driven tools that together expand access to capital. Whether you’re curious about earning fees through liquidity mining or just want to know how a token swap works, the concepts above form the backbone of today’s financial innovation.

Below, you’ll find a curated list of articles that break down each element in plain language. From beginner‑friendly overviews to deeper dives into risk management, the collection is built to give you actionable insight and a clear road map through the fast‑moving world of finance.

Lease Pull-Ahead Programs: How to Exit Your Car Lease Early for Less

- 9 Comments

- Jan, 5 2026

Lease pull-ahead programs let you exit your car lease early for little or no cost by trading in your current vehicle for a new one from the same brand. Learn how to find these hidden offers and save thousands.

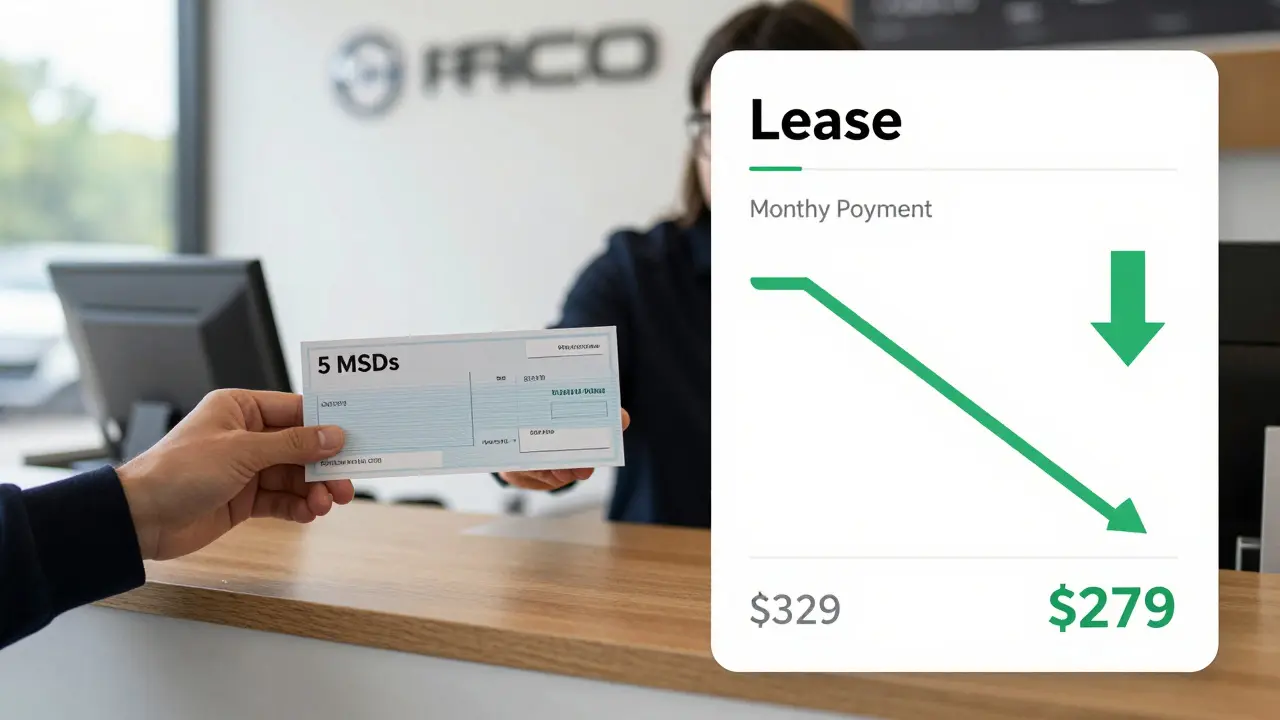

How to Use Multiple Security Deposits to Lower Your Car Lease Payments

- 14 Comments

- Dec, 16 2025

Learn how Multiple Security Deposits (MSDs) can lower your car lease payments by reducing your interest rate-without losing your money. Get the math, real examples, and how to ask for them.